Data analytics for banks

Gain deeper customer insights by leveraging an advanced analytics platform to analyze transactions, deposits, and loan data.

Increase profitability with data-driven insights

Use the GoodData platform as a standalone solution, or embed it into your application or portal.

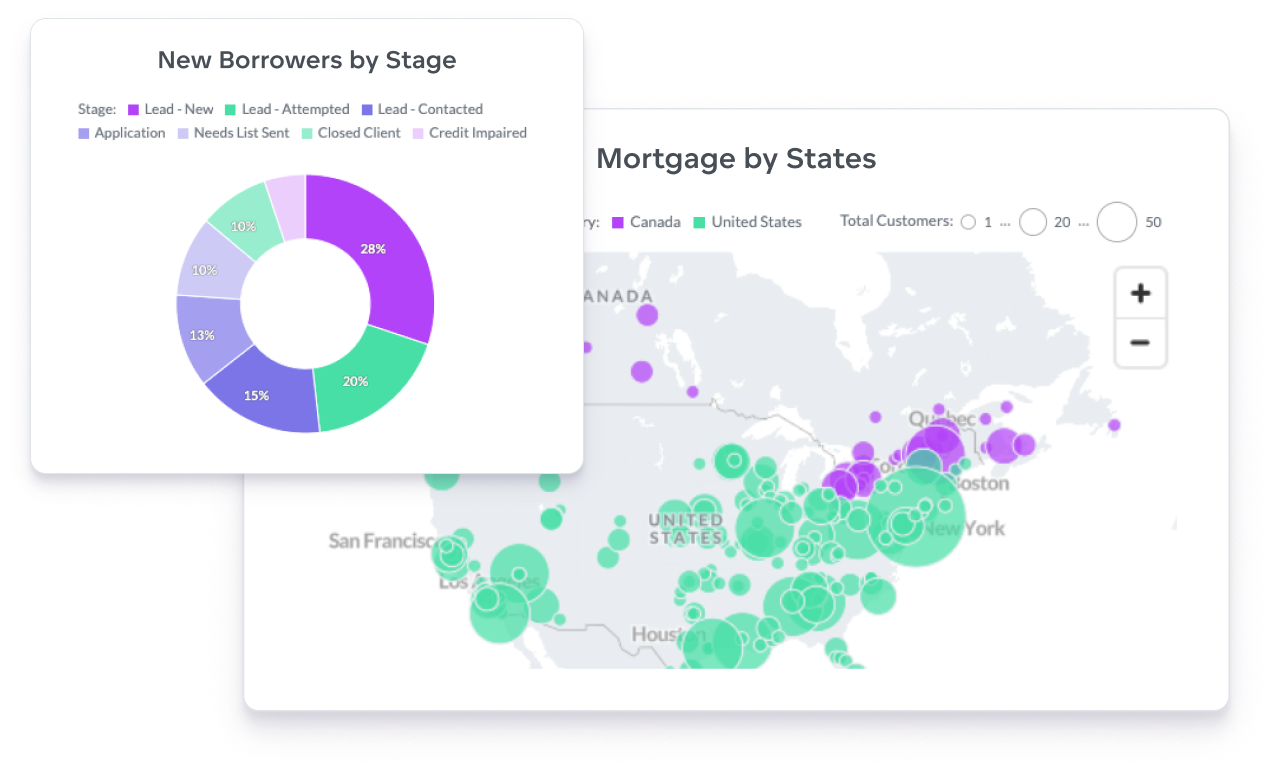

Get mortgage broker analytics

- Gain instant access to customer loan status, product type, and overall portfolio across channels.

- Use advanced analytics to increase revenue and upsell opportunities.

Reduce credit loss

- Enable bank personnel to rapidly identify at-risk borrowers.

- Quickly spot anomalies such as unusual account activity, credit risk, information security, and market and liquidity demands.

- Mitigate credit loss, increase profitability and liquidity.

Ensure compliance at every step

- Get a comprehensive view of regulatory discrepancies.

- Connect notifications and alerts to your data to proactively mitigate compliance issues.

Dive deep into our success stories

Examples of dashboards for banks

Explore how banks are leveraging analytics dashboards

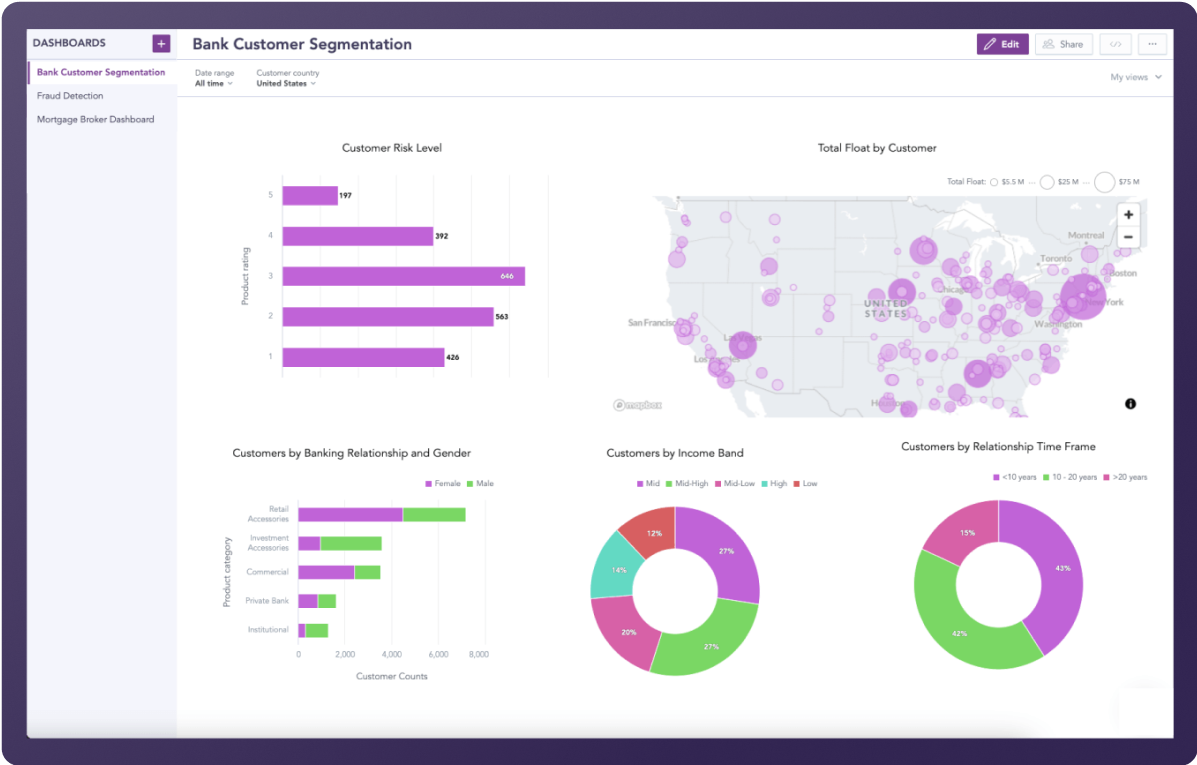

Understand your customer base

Banks can get a comprehensive overview of their current status with metrics like total deposits and loans. Customers are organized into segments for increased understanding.

- Drill into data for further insights.

- A range of visualizations to tell the data story.

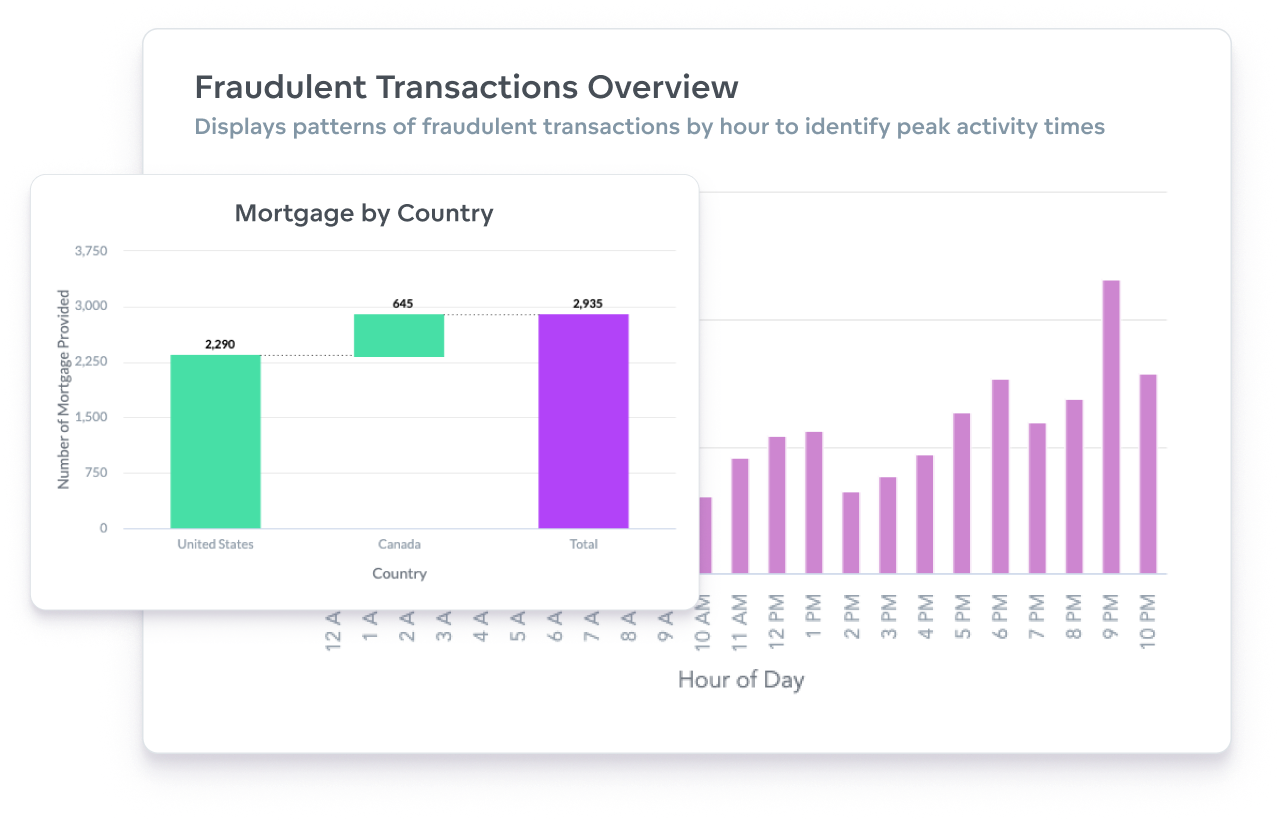

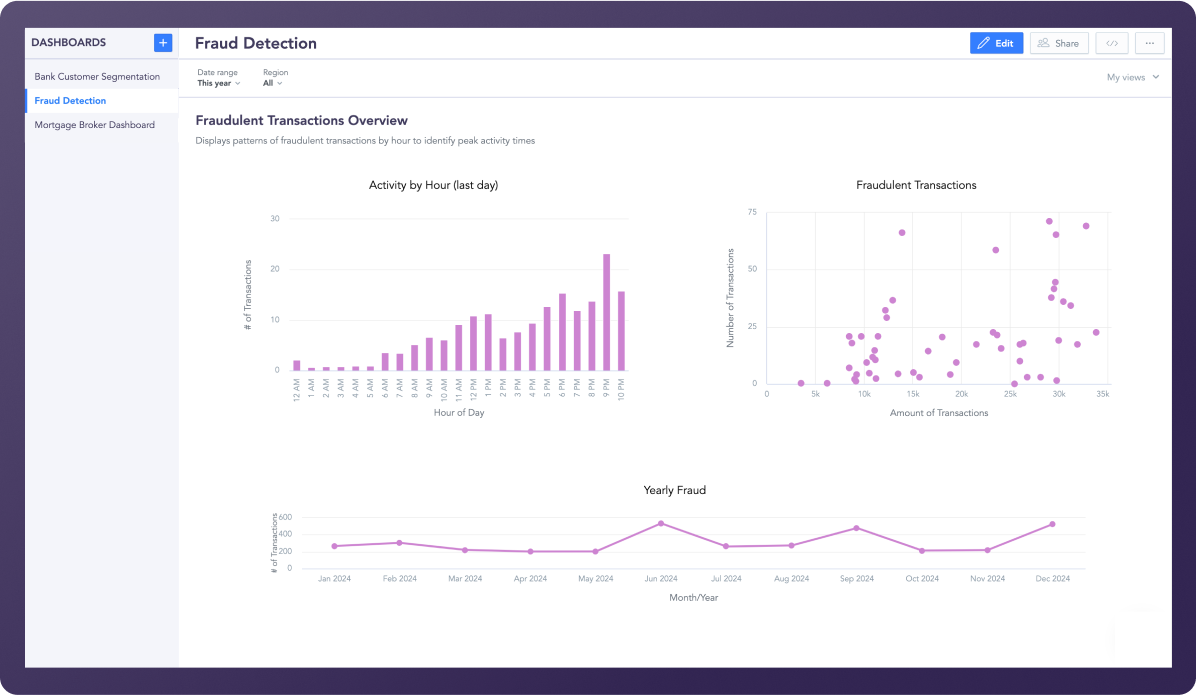

A bird's-eye view of fraud status

Delivers real-time fraud data to assess current threats and proactively mitigate future risks. Key metrics include defrauded amount, total fraudulent transactions, and number of fraudulent customers.

- Easily shareable with teams and stakeholders.

- Fully customizable to match any brand.

Discuss your use case with us

See how GoodData can help with your analytics goals.

Why choose our analytics platform?

Reasons why companies love our analytics platform include:

Smoothly implement in your ecosystem

Deploy in GoodData Cloud

GoodData Cloud is a SaaS product operated and maintained by us. Customers receive continuous code updates and it can be deployed in AWS, Azure, and multi-region.

Deploy Self-hosted

Self-hosted uses the same codebase as GoodData Cloud and is ideal for users needing enhanced security, governance, or control for data residency or regulatory compliance.

Integration

Open APIs and declarative SDKs — connect to code repositories and 3rd-party apps, embed anywhere.

Security and governance

Trusted analytics — certifications, inherited permissions, and cascading content changes for easy admin.

Accessibility

Accessible analytics — ensuring compliance and delivering inclusive experiences.

A trusted platform, loved by users

Common questions

There are several things to consider when deciding on an analytics tool. Here's a step-by-step guide to help you make the right choice for a banking business:

- Define your requirements: Start by clearly defining your analytics requirements. Identify the specific use cases and key performance indicators (KPIs) you want the BI tool/analytics platform to support.

- Evaluate features and functionality: Look for an analytics platform that offers features and functionality tailored to complex banking infrastructural needs. Key features to consider include:

- The highest standards of data security and compliance,

- Trusted data governance including comprehensive testing, validation, and monitoring for consistent and accurate data, no matter where it is consumed

- Data visualization options,

- Ad-hoc reporting with drill-down capabilities,

- Predictive analytics,

- Rich integration options.

- Scalability and flexibility: Choose an analytics platform that can scale as your requirements change.

- Ease of use: Choose a BI tool that is user-friendly and intuitive, allowing bank professionals with varying levels of technical expertise to easily access and analyze data. Look for features such as drag-and-drop interfaces, customizable dashboards, and self-service analytics capabilities.

- Vendor reputation and support: Read customer reviews, case studies, and analyst reports to assess the vendor's reliability, customer satisfaction, and level of support.

- Cost considerations: Evaluate the total cost of ownership (TCO) of the BI tool, including licensing fees, implementation costs, training expenses, and ongoing support and maintenance costs.

Try GoodData yourself

See how GoodData can help with your analytics goals