4 Benefits of AI for Insurance Analytics

The data-rich nature of insurance organizations makes harnessing the power of analytics a no-brainer which, until recently, has been overlooked by many insurers. However, with the industry’s recent shift to a more customer-oriented focus, along with the constant increase in the amount of data being collected, insurers have now begun to realize the benefits of analytics.

In order to stay ahead of the competition and make the most of all of this data, insurers should strive to harness the power of artificial intelligence (AI), with the benefits of doing so stretching far beyond the typical time and cost reductions. Organizations that exploit this technology will emerge as industry leaders — while those who don’t will soon find themselves lagging behind.

So, with the above in mind, let’s take a look at four areas in which the biggest gains can be made and how integrating them into your insurance strategy can help drive your business forward.

AI delivers increased access to data and insights

Introducing AI into a workflow requires companies to build a better, more accurate data foundation, and that improvement starts to help employees before AI is even used. Let’s consider an employee who is trying to determine if particular customers are spending too much time in the service center especially if they have a low expected lifetime value. With access to customer journey analytics and insights, the underwriter is provided with a predicted lifetime value score and is able to use this to drive a better pricing decision.

Once AI is introduced, any actions that have been already taken, along with the customer’s information, can be sent to the machine-learning model. In turn, this helps to improve future outcomes and ensure that the sales and marketing teams are targeting the most profitable customers — and avoiding those customers that are likely to be unprofitable.

Experience GoodData in Action

Discover how our platform brings data, analytics, and AI together — through interactive product walkthroughs.

Explore product toursThe right insights are delivered to the right people at the right time

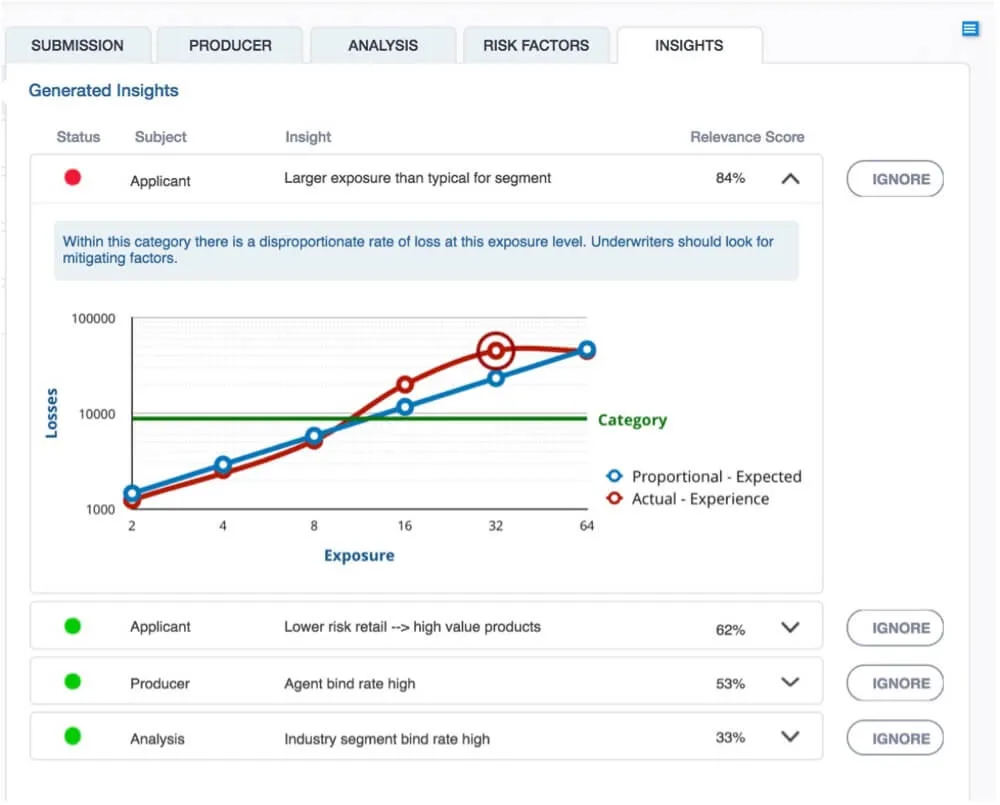

When a submission is sent to underwriting, it’s first scored against predictive models in real-time for areas like “broker sincerity” or “projected loss ratio for this class.” AI can then create a ranking system for those submissions, helping to answer questions like “Which risk should I work on next that will be most advantageous for our company?”

Digitizing the underwriting process with AI, therefore, enables the underwriter to determine the best course of action based on the insights presented. In this case, AI helps bridge the gap between the insight and the action taken by the employee based on the recommendation provided by the AI engine.

AI Recommendation: Exposure higher than the average, suggest adding a surcharge to the standard premium.

AI ensures consistent employee performance

Because AI eliminates much of the guesswork associated with decision-making, decisions become more accurate, correct, and consistent. While training is still a necessary component, using AI helps less experienced employees learn much more quickly because they’re getting recommendations based on past decisions that have already been validated. This helps to eliminate much of the risk associated with a new employee.

While a less experienced insurance claims adjuster may overcompensate a customer for a claim, an adjuster supported with the power of AI can be guided through recommended next steps based on past experiences, all within the one analytics system.

Employees make faster, better, data-driven decisions

Consider an insurance company trying to fight fraud. Unlike humans, AI is able to read and rely on huge amounts of historical data based on fraudulent claims. This helps the AI to quickly improve its understanding of typical fraud patterns, with the end resulting being that future fraud is identified much more quickly and accurately. Far beyond what is possible for a human counterpart to calculate and act upon.

Moreover, when a fraudulent pattern is recognized, the claim is immediately routed to the Special Investigations Unit (SIU), responsible for looking deeper into potential fraud cases, and further investigated. The results and feedback obtained from their investigation of the claim, further enable the fraud models, on which the AI depends, to continuously improve, becoming smarter and more accurate with each new claim referred to the SIU.

A recap on the benefits of insurance AI

When taking into account the benefits outlined here:

- Increased access to data and insights

- The right insights to the right people at the right time

- Consistent employee performance

- Faster, better, data-driven decisions

...it’s apparent that insurance companies should be looking to incorporate AI into the daily workflow of the claims department. By driving analytics adoption and the use of AI, insurance companies can ensure the right insights get to the right people, helping them to realize organization-wide data-driven decision making. Not only does this help in streamlining company efficiency, but also aids in clearly differentiating themselves from their competitors, with both outcomes ultimately resulting in increased profitability.

And it’s clear to see that with over 40% of CIOs planning to increase their spending on AI in 2021, the industry is quickly waking up to these benefits. Do you have AI and analytics on your radar?

Ready to learn more?

Are you interested to learn more about how analytics can benefit your insurance company? Take a look at this infographic to understand how you can future-proof for tomorrow with analytics, or head to our product page to learn more about how the GoodData platform can help you realize the benefits of AI for insurance.

Alternatively, if you want to experience the GoodData platform straight away, request a demo and let our experts take you on a guided tour. They’ll help you discover its rich feature set and ease of implementation as well as answer your questions.

Experience GoodData in Action

Discover how our platform brings data, analytics, and AI together — through interactive product walkthroughs.

Explore product tours