Insurance data analytics

Transform insurance data into actionable insights you can trust with our AI-fueled analytics tools.

Get insurance insights to where they’re needed most

Improve processes and quickly deliver analytics to adjusters, underwriters, sales teams, and more.

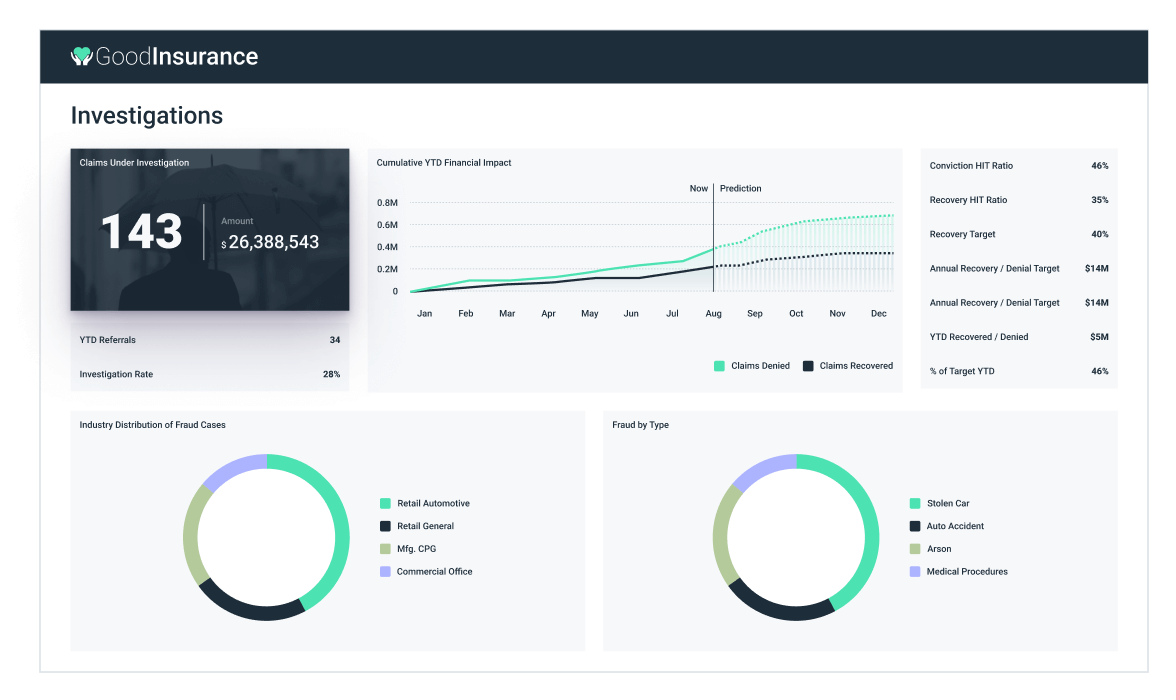

Tackle insurance fraud

- Leverage AI-powered predictive analysis for early detection of fraudulent claims.

- Empower end users with the best visualizations to help them identify trends.

- Set up automated alerts based on the identified patterns.

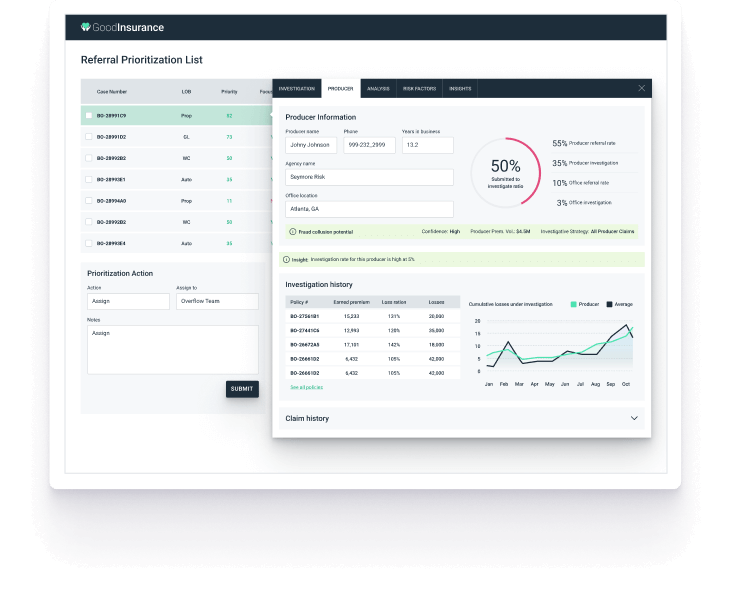

Improve underwriting processes

- Get an accurate view of each stage of underwriting via interactive dashboards.

- Use the GoodData BI platform to detect anomalies and isolate potential issues.

- Check previous submissions to discover key information such as premium variance.

Manage claims efficiently

- Impress insurance customers with a simple, fast claims process powered by automation.

- Obtain accurate information about previous and open claims.

- Give claims handlers detailed customer analysis, enabling a personalized service.

Empower sales teams

- Equip sales managers with detailed insurance product information across territories.

- Enable real-time reporting and detailed visualizations for sales teams to react to shifting trends.

- Leverage AI-fueled forecasting to identify areas with future potential.

Dive deep into our success stories

Dashboards for all insurance needs

Check out some of the ways insurers are using GoodData dashboards.

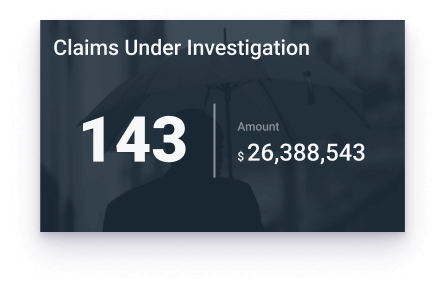

Overview of KPIs vital to claims processing

Claims leaders can see claims trends by line of business, industry, or cause of loss. Key metrics such as Average Number of Days to Close, Reserve Deviation, etc, are revealed.

- Option to drill-down for further analysis.

- Customized visualizations for at-a-glance insights.

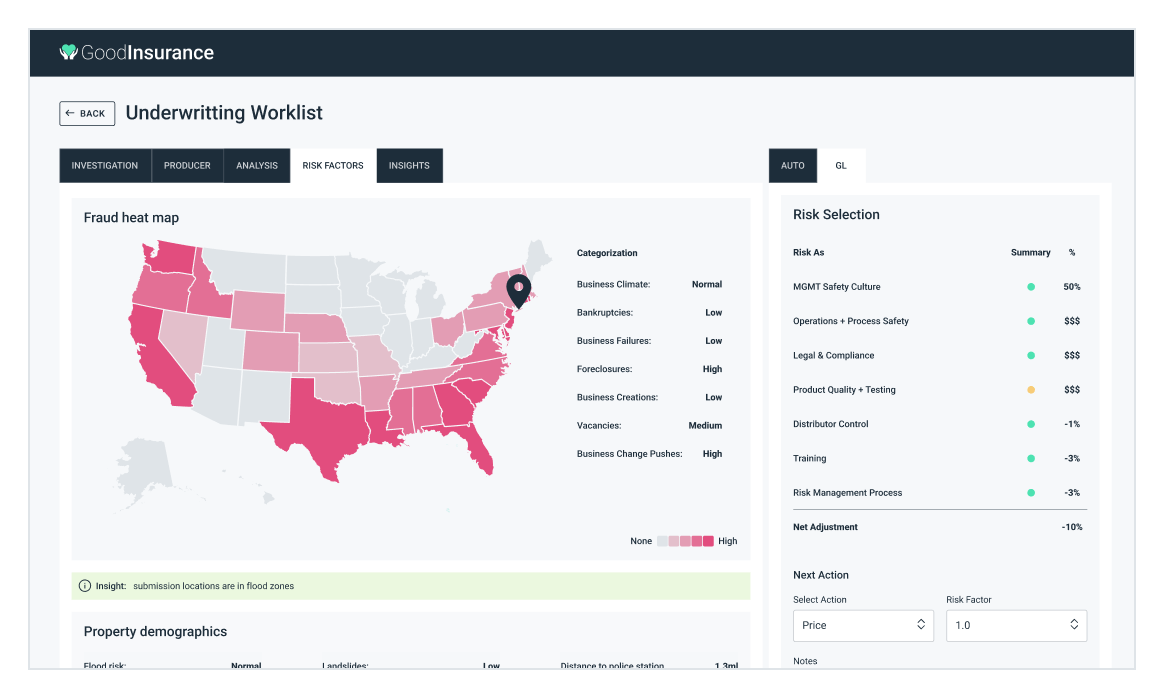

Comprehensive view of the risk factors in the claim region

Claims teams can get data points in the target region to make educated claim evaluation and effectively identify potential fraudulent claims.

- Fraud Heat Map for easy insights.

- Property demographics highlight additional risks.

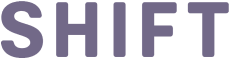

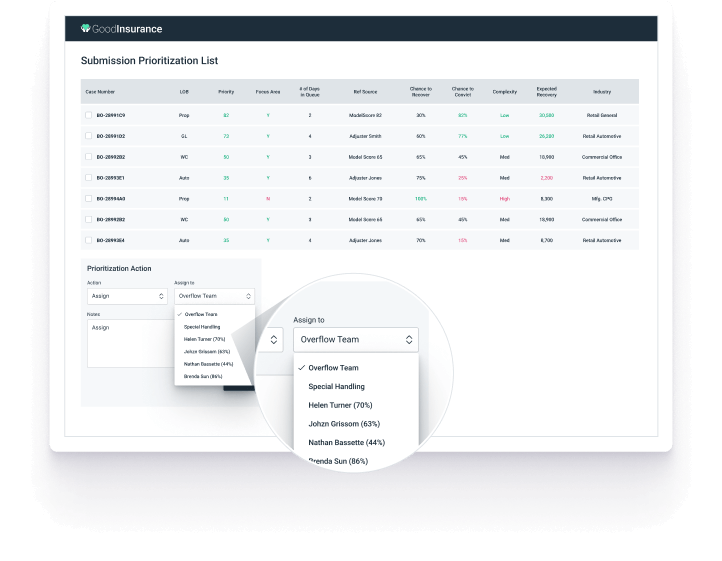

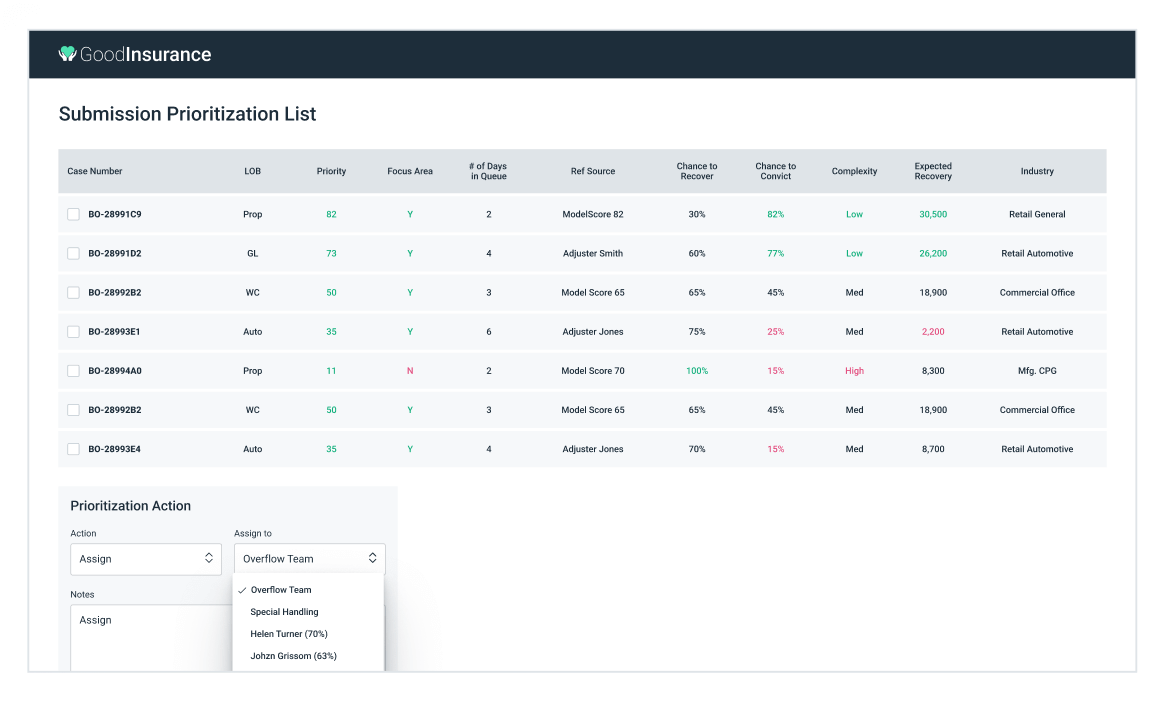

Understand and prioritize the submission queue

Underwriting manager can prioritize based on key information and metrics for each submission, and then assign to the best person to drive the best business outcome.

- User-friendly UI.

- Easily assign submissions to team members.

Discuss your use case with us

See how GoodData can help with your analytics goals.

Why choose our analytics platform?

Reasons why companies love our analytics platform include:

Smoothly implement in your ecosystem

Deploy in GoodData Cloud

GoodData Cloud is a SaaS product operated and maintained by us. Customers receive continuous code updates and it can be deployed in AWS, Azure, and multi-region.

Deploy Self-hosted

Self-hosted uses the same codebase as GoodData Cloud and is ideal for users needing enhanced security, governance, or control for data residency or regulatory compliance.

Integration

Open APIs and declarative SDKs — connect to code repositories and 3rd-party apps, embed anywhere.

Security and governance

Trusted analytics — certifications, inherited permissions, and cascading content changes for easy admin.

Accessibility

Accessible analytics — ensuring compliance and delivering inclusive experiences.

GoodData solutions for insurance

Speed. Insights. Agility.

Claims insights

Provides a 360-degree view of the claims by combining internal and external claims data.

Underwriting insights

Enables timely delivery of insights to support better risk assessment and pricing decisions.

A trusted platform, loved by users

Common insurance analytics questions

Insurance analytics involves the use of data analysis and statistical modeling to extract meaningful insights and improve decision-making within the insurance industry. It plays a crucial role in assessing and managing risks, enhancing operational efficiency, and optimizing customer experiences. By leveraging data from various sources, such as customer information, claims data, and market trends, insurance analytics helps companies gain a comprehensive understanding of their business.

Data analytics holds significant importance in the insurance industry because it allows companies to harness the power of data for informed decision-making. This data-driven approach enables them to accurately assess risks, detect fraud, and optimize pricing strategies. In essence, the use of data analytics in the insurance industry is instrumental in improving overall performance, reducing costs, and delivering more tailored and effective services to policyholders.

Big data has revolutionized the analytics industry by providing the capability to process and analyze massive volumes of diverse and complex data sets. With big data analytics, businesses can uncover patterns, trends, and correlations that were previously difficult to discern. Overall, the advent of big data has transformed the analytics industry by enabling professionals to derive deeper and more meaningful insights from the wealth of information available, leading to more informed and impactful strategies.

Your insurance company can reap numerous benefits from analytics. Firstly, analytics allows for a thorough assessment of risks by analyzing extensive data sets, helping you make more accurate underwriting decisions and detect potential fraud. Additionally, it enhances operational efficiency by streamlining processes and automating routine tasks. Analytics enables personalized customer experiences by analyzing customer data, allowing you to tailor products and services to individual needs. Overall, leveraging analytics in your insurance company can lead to improved decision-making, cost reduction, and a more responsive and competitive position in the market.

Try GoodData yourself

See how GoodData can help with your analytics goals