Financial Forecasting That Works: Everything You Need to Know

What Is Financial Forecasting?

Financial forecasting is the practice of using data to estimate future financial conditions. It helps institutions anticipate changes in cash flow, balance sheets, revenue, and profitability based on internal performance and external factors such as interest rates or market volatility.

While financial forecasting is commonly associated with budgeting, in financial services it has a broader role. It informs everything from liquidity management to capital adequacy and product strategy. Used well, it becomes an essential part of a firm’s long-term resilience and short-term adaptability.

The Benefits of Financial Forecasting in Financial Services

For financial services companies, forecasting is not just helpful but mission-critical. Institutions face constant exposure to market movements, customer behavior shifts, and regulatory pressures. A well-developed forecast enables leaders to manage these risks proactively. For example:

- Banks use forecasting to manage interest rate risk, predict deposit flows, and align loan portfolios with expected demand.

- Insurance companies rely on analytics to estimate future claims, set premium pricing, and maintain solvency ratios.

- Investment firms forecast asset performance to manage portfolios, optimize liquidity, and evaluate market entry or exit timing.

Forecasting is also crucial for regulatory compliance. For instance, Basel III for banks and Solvency II for insurers require institutions to show forward-looking risk management. Accurate forecasting models are essential to meet those demands.

In short, financial forecasting provides the clarity needed to make informed, timely decisions. It helps firms safeguard liquidity, manage capital, and plan for both growth and disruption.

Forecasting allows financial organizations to proactively adjust strategies

Financial Modeling vs. Forecasting: What’s the Difference?

These two terms are often used interchangeably, but serve different purposes.

- Financial forecasting is about predicting future outcomes based on historical and current data. It focuses on answering questions like How much revenue will we generate next quarter? or What will our liquidity look like under stress?

- Financial modeling is the process of building structured representations of a company’s financial situation. These models are often used to simulate forecasts, evaluate strategies, or assess the impact of decisions.

Used together, modeling and forecasting give financial institutions both a realistic view of the future and a sandbox for planning.

Types of Financial Forecasting

Financial services companies use a range of forecasting types, each serving a distinct purpose. The accuracy of each of the below depends on the quality of data, the forecasting model used, and how well it fits the specific business context.

- Cash flow forecasting predicts the timing and amount of cash inflows and outflows. It is crucial for maintaining liquidity and avoiding shortfalls. Banks use it to anticipate funding needs or stress-test liquidity. Insurers apply it to manage claim payments and premium income.

- Revenue forecasting estimates expected income from core operations. In banking, this may include interest income, fee-based services, or trading gains. In insurance, it typically focuses on premium income across different product lines and channels.

- Balance sheet forecasting models the future state of assets, liabilities, and equity. It helps financial institutions align capital allocation with growth strategies and regulatory requirements.

- Profit and loss forecasting provides a view of expected profitability, helping leaders to understand the relationship between revenue, expenses, and margins. It is a key input into strategic planning, performance monitoring, and shareholder reporting.

Industry-Specific Applications

Financial forecasting looks different depending on the type of business. For example, banking forecasts often focus on credit risk, using models that estimate the likelihood of loan defaults. In insurance, forecasting is about predicting how often claims will happen and how much they might cost.

Types of Forecasts and Their Use Cases in Banking vs. Insurance

| Forecast Type | Banking Use Case | Insurance Use Case |

|---|---|---|

| Cash Flow Forecasting | Managing interbank liquidity and regulatory stress tests | Predicting claims payout timing and premium inflows |

| Revenue Forecasting | Estimating loan and interest income, fee revenue | Forecasting premium income across different insurance lines |

| Balance Sheet Forecasting | Aligning capital ratios with Basel III requirements | Planning reserves in line with Solvency II compliance |

| Profit and Loss Forecasting | Setting growth targets and adjusting lending margins | Projecting underwriting profit and investment income |

| Scenario Forecasting | Modeling impacts of economic shifts on credit portfolios | Simulating disaster events and evaluating claims exposure |

Financial Forecasting Methods and Models

Financial services companies apply both quantitative and qualitative approaches depending on the objective, data availability, and risk profile.

Qualitative forecasting is based on expert judgment, market research, or consensus. It’s commonly used when historical data is limited or when forecasting the impact of events like regulation changes or geopolitical shifts.

Quantitative forecasting relies on historical data and statistical techniques. It is the preferred approach for most financial services forecasting due to its consistency, repeatability, and ability to scale with data.

The accuracy of a financial forecast depends heavily on the model and method used:

- Time-series analysis: This is one of the most common forecasting methods in finance. It analyzes historical data points (e.g., daily interest rates or monthly cash flows) to identify patterns and project future values. It’s frequently used for revenue forecasting and interest rate modeling.

- Regression analysis explores relationships between variables, such as the link between unemployment rates and loan default probabilities. It’s a good solution when you need to understand cause-effect dynamics and improve forecast precision with explanatory variables.

- Scenario Planning models help institutions explore multiple future outcomes based on changing assumptions. For example, a bank might forecast capital adequacy under different macroeconomic conditions like rising inflation or a recession.

- Monte Carlo methods simulate thousands of possible outcomes to model uncertainty and risk. They are widely used for credit risk, investment portfolio performance, and insurance underwriting. These simulations offer a statistical distribution of outcomes, helping financial institutions assess probability and prepare accordingly.

The Financial Forecasting Process: Step-by-Step

Forecasting is a structured and repeatable process; while the steps may vary slightly between institutions, the core process remains consistent.

Step 1: Collect and Integrate Your Data

Accurate forecasts start with accurate data. You must first consolidate information from core systems (such as lending platforms, claims management, or treasury systems) along with external inputs like interest rates or economic indicators.

This step often requires connecting siloed data sources. Financial analytics software can automate this process, pulling data into a centralized environment and reducing the risk of errors that occur in manual workflows.

Step 2: Set Your Assumptions

Once the data is in place, your teams can define the assumptions that shape the forecast. These include key drivers like market growth rates, default probabilities, customer behavior, or cost trends.

Assumptions should be based on evidence and reviewed collaboratively across departments. In regulated environments, it’s also important to document how and why each assumption was made, especially in audit scenarios.

Step 3: Build Your Model

Next comes model creation: choosing the forecasting method (e.g., linear regression, time-series, or scenario models) and applying it to the data. Banks might model loan loss provisions, while insurers might focus on claims frequency and severity.

The sophistication of these models can vary. Some teams build custom models in-house, while others use a data analytics platform. Either way, aligning models to your institution’s appetite for risk and strategic goals is critical.

Step 4: Validate and Backtest

Validation involves comparing historical forecasts to actual performance. The goal is to measure accuracy, identify systematic errors, and improve future predictions.

Backtesting should be conducted regularly. It helps your teams understand how models behave in different market environments and informs adjustments to assumptions or structure.

Step 5: Review and Adjust Your Forecast

Once validated, your forecasts can be reviewed by key decision-makers (typically finance, risk, and business line leaders). This step ensures that forecasts are aligned with current strategy and regulatory requirements.

Adjustments may be made due to new market information, changes in assumptions, or updated business priorities. Flexibility gains importance in these situations, especially in fast-moving sectors like banking or insurance.

Automation Opportunities in Each Financial Forecasting Step

As financial institutions scale their forecasting operations, automation helps reduce effort, increase transparency, and deliver fast forecasts that decision-makers can trust. Here are some instances where automation is a possibility:

| Forecasting Step | Automation Opportunity |

|---|---|

| Data Collection | Real-time data ingestion and consolidation |

| Assumption Setting | Pre-built input libraries and audit logs |

| Model Building | Reusable templates and low-code configuration |

| Validation & Backtesting | Auto-generated accuracy reports and trend analysis |

| Review & Adjustment | Alerts for material deviations and version control of forecast updates |

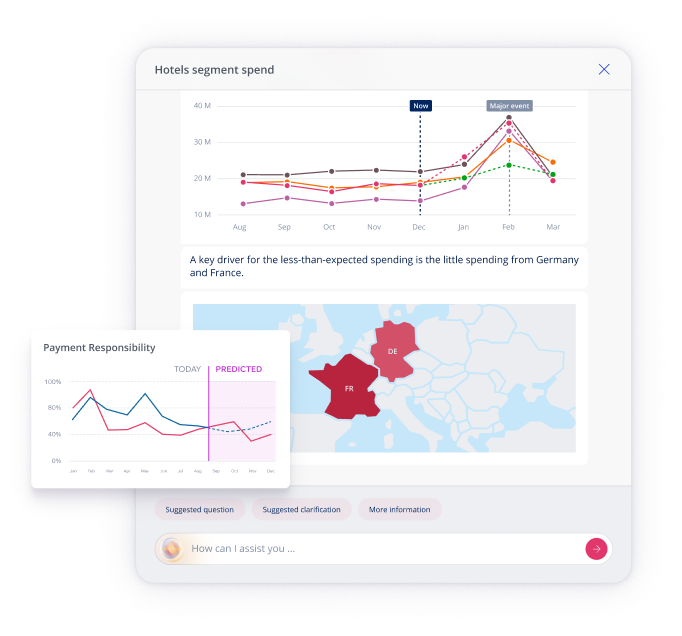

How Financial Forecasting Tools Streamline the Forecasting Process

Modern BI tools enable quicker, more accurate forecasts by streamlining data access, improving collaboration, and supporting flexible scenario planning. They achieve this by ingesting real-time data from systems like ledgers or claims databases, along with external sources such as interest rates and macroeconomic indicators. Cross-functional teams (finance, risk, compliance) can work from shared data and assumptions, reducing duplication and ensuring consistency. These tools also enable scenario planning, allowing users to model different economic outcomes and instantly re-forecast when conditions shift. They also allow teams to effectively visualize the data so that everyone can understand what they’re seeing.

Forecasts are typically shared with partners or customers via dashboards

AI in Financial Forecasting

Artificial intelligence has already become critical to how banks, insurers, and investment firms create accurate forecasts. And according to a recent report, CFOs expect AI to improve forecast accuracy by 24 percent by 2027.

AI models can analyze large datasets, spot hidden patterns, and adapt quickly to new information. For example, machine learning can detect shifts in credit risk or rising operational costs before they appear in traditional reports.

Unlike static models, AI continuously updates forecasts based on real-time inputs such as market trends or consumer behavior.

Unlike static models, AI continuously updates forecasts based on real-time inputs such as market trends or consumer behavior.

In banking, AI is used to forecast credit risk by analyzing transactional behavior, loan repayment patterns, and broader economic indicators. This helps lenders make faster, more informed decisions, especially under uncertain conditions.

In insurance, AI supports underwriting by predicting claims likelihood and adjusting pricing in real time. It also enhances fraud detection by identifying irregular claims or transactions that may indicate suspicious activity.

Common Challenges in Financial Forecasting

Even leading financial institutions face forecasting challenges; 40 percent of CFOs admit their forecasts are often inaccurate and take too long to produce.

Below are some of the challenges that can limit accuracy, reduce confidence in decision-making, and slow down responsiveness in fast-moving markets.

1. Data Quality and Integration

Forecasting is only as strong as the data it relies on. Financial services organizations often run into problems with inconsistent data formats, duplicate records, or gaps in historical information. Integrating data from various departments (risk, finance, compliance, operations) adds further complexity. Without a unified data model, teams may rely on outdated or incomplete information, which undermines forecast credibility.

2. Legacy Systems

Many banks and insurers still depend on legacy systems that were not built for agile forecasting. These systems can limit data access, reduce modeling flexibility, and make real-time analysis difficult or impossible. They also make it hard to implement advanced forecasting techniques like scenario simulation, machine learning, or real-time adjustments, slowing down innovation and increasing operational risk.

3. Siloed Departments

In many organizations, forecasting is carried out in silos. The finance team may create forecasts independently from risk, actuarial, or operations teams, which leads to conflicting assumptions and inconsistent outputs. This lack of coordination can result in duplicated effort, missed dependencies, and poor alignment with the overall business strategy.

4. Forecast Bias and Over-Reliance on Historical Data

Financial institutions often default to using historical data as a baseline, assuming the future will mirror the past. This introduces risk, especially in times of volatility or disruption. Human bias, such as overly optimistic revenue projections or conservative cost estimates, can also skew forecasts, leading to misguided decisions.

Best Practices for Effective Financial Forecasting

Strong forecasting is built on process, not just models. To stay effective in fast-changing markets, financial institutions need adaptable, transparent, and well-aligned practices. Doing the following can help:

- Frequent Reforecasting: Quarterly updates are often too slow. Leading firms use rolling forecasts (updating monthly or even weekly) to reflect new data, interest rate changes, or regulatory shifts.

- Collaborative Forecasting: Accurate forecasts rely on input from finance, risk, compliance, actuarial, and other teams. Shared environments make it easier to align on assumptions and reduce duplication. Many of these needs are supported by modern BI tool features, including shared data models and built-in governance.

- External Data Integration: Bringing in macroeconomic indicators like inflation or GDP adds vital context. This supports better planning, stress testing, and regulatory alignment.

- Audit Trails and Documentation: Clear records of how forecasts are built and changed help ensure transparency, reduce risk, and facilitate compliance reviews. Documenting assumptions also makes future updates faster and more reliable.

The video below shows forecasting in action:

Real-World Financial Forecasting Examples

Below are two real-world examples that illustrate how financial forecasting drives better decisions, improves risk posture, and sharpens pricing strategy.

Example 1: A Bank Adjusting Credit Risk Exposure

A commercial bank faces growing uncertainty in the macroeconomic environment. To manage loan book risk, the bank uses forecast models to project future credit losses under various economic scenarios. These models integrate internal historical loan performance data, real-time transaction activity, and external indicators such as unemployment rates, interest rate expectations, and consumer sentiment.

By forecasting credit defaults under different stress conditions, the risk team can:

- Rebalance loan portfolios

- Adjust lending criteria by sector or region

- Increase reserves or reduce exposure in high-risk areas

This approach supports regulatory compliance (e.g., IFRS 9 or CECL), improves resilience, and enables proactive risk mitigation.

Example 2: An Insurance Company Forecasting Claims Ratios

A property and casualty insurer wants to fine-tune its premium pricing model for a new product launch. To do so, it builds forecasting models for claims ratios, factoring in:

- Historical claims patterns

- Seasonal and geographic risk trends

- Climate-related event data (e.g., hurricanes, floods)

- Policyholder demographics and behavior

The model runs multiple simulations to project loss ratios over the next 12 to 24 months. These forecasts help the pricing team to set premiums that reflect expected risk and cost, maintain profit margins while staying competitive, and plan capital allocation in line with projected liabilities.

How to Create the Best Financial Forecasts

The good news is that financial forecasting doesn’t require starting from scratch. You can begin by identifying gaps in your current processes, such as outdated spreadsheets, siloed data, or poor collaboration. Next, centralize your data to combine internal metrics with external market signals for better context. Then choose forecasting software that supports real-time updates, AI-driven accuracy, secure collaboration, and compliance. GoodData can help with all of this and more (feel free to book a demo to find out how).

Summary

Financial forecasting is the process of predicting future financial outcomes based on historical data, market trends, and internal business inputs. For financial services companies like banks and insurers, it is critical for managing risk, maintaining compliance, and allocating capital strategically.

Modern financial forecasting delivers measurable benefits, including better liquidity planning, more accurate credit risk evaluation, and stronger operational resilience. The rise of AI-powered forecasting is accelerating these advantages, helping institutions to improve accuracy and react faster to market volatility.

The right analytics software plays a central role by enabling real-time data analysis, scenario modeling, and collaborative forecasting processes. With the right tools and techniques, financial forecasting becomes a key competitive advantage.

FAQs About Financial Forecasting

Techniques like scenario analysis, Monte Carlo simulations, and AI-based predictive modeling help financial professionals improve forecast accuracy and account for uncertainty. These methods are especially valuable in fast-moving markets where traditional forecasting models may fall short.

The ideal forecast horizon depends on the business objective. Short-term forecasts (up to 12 months) support cash flow and budgeting, while long-term forecasts (3–5 years) aid in strategic financial planning and capital allocation for financial services firms.

Whether you’re an enterprise or SMB, Forecasts should be updated regularly (monthly or quarterly is common). However, in volatile markets, many financial institutions adopt rolling forecasts and real-time updates using financial forecasting software for more agile and informed decision-making.

Financial forecasting in management is the process of estimating a company's future financial performance by analyzing historical data, current business trends, and relevant external factors. It provides projections of revenues, expenses, cash flows, and profitability to support strategic decision-making, budgeting, and planning.

Time-series models, stochastic simulations, and stress testing frameworks are effective at capturing market volatility and economic risks. These are often combined with external macroeconomic indicators to enhance financial forecasting accuracy.

Ensemble forecasting, which merges outputs from several models, helps mitigate bias and reduce forecast error. Combining qualitative insights with quantitative models improves reliability across use cases like credit risk and claims forecasting.

Accurate financial forecasts support compliance with regulations like Basel III and Solvency II by informing capital adequacy, liquidity planning, and risk exposure. Regulators increasingly expect forward-looking risk assessments as part of ongoing reporting requirements.