AI in Financial Services and Banking: How Organizations Progress from Analytics to Agents

Summary

Financial institutions are under pressure to deliver faster, more personalized service at scale. That pressure has moved AI in banking and financial services out of innovation labs and into production. This article categorizes AI adoption into distinct levels, ranging from AI-powered analytics and chatbots to generative AI agents and autonomous, agentic AI. By understanding the spectrum, you can choose the right level for your organization’s goals and build a safe path to measurable impact.

Understanding the AI Spectrum in Financial Services

AI technologies in financial services fulfill a range of purposes. Conversational systems, generative models, and autonomous agents solve unique challenges, each requiring specific levels of data quality, governance, and operational maturity.

Early-stage AI focuses on understanding data. It analyzes transactions, monitors risk, and generates forecasts, while humans retain decision control.

As institutions mature, AI becomes more interactive. Conversational systems support customers and employees through guided, multi-step interactions.

Generative AI in financial services goes further. It synthesizes structured and unstructured data across sources to produce insights and recommend actions, not just respond to questions.

At the most advanced stage, AI systems operate autonomously. Agentic AI continuously monitors conditions, makes decisions, and executes actions within defined boundaries.

Choosing the right AI approach depends on three core factors:

- Data readiness: Advanced AI cannot perform reliably without governed, trusted data.

- Use case requirements: Simple tasks demand different tools than complex, judgment-heavy workflows.

- Organizational goals: Efficiency, growth, and risk management place different demands on AI financial services strategies.

Understanding where your organization sits on this maturity curve helps avoid over-investment and regulatory risk. To assess your current position and identify the right next step, check out our AI maturity model for financial services.

The Five Levels of AI Implementation in Banking

Banking AI can be grouped into five levels, starting with AI-powered analytics and progressing through chatbots, conversational AI and copilots, generative AI agents, and autonomous agentic AI.

| Level | AI Type | Autonomy Level | Human Involvement | Example Use Case |

|---|---|---|---|---|

| 1 | AI-Powered Analytics | Passive | Humans interpret insights | Automated dashboards for risk monitoring |

| 2 | AI Chatbots & Assistants | Reactive | Responds to user queries | FAQ automation, account queries |

| 3 | Conversational AI & Copilots | Interactive | Collaborates with humans | Guided loan applications, investment advice |

| 4 | Generative AI Agents | Proactive | Creates and recommends | Fraud pattern detection, personalized recommendations |

| 5 | Autonomous Agentic AI | Autonomous | Acts independently with oversight | Portfolio rebalancing, real-time risk assessment |

Level 1: AI-Powered Analytics: Your Foundation for Intelligence

AI-powered analytics is the starting point for AI in banking because every advanced capability depends on trusted data. Before conversational AI, generative models, or autonomous agents can work reliably, institutions need consistent metrics, governed data access, and real-time visibility across the business.

At this level, AI supports understanding rather than action. The focus is on analyzing data, identifying patterns, and predicting outcomes while humans remain fully in control.

AI-powered analytics create a shared semantic layer that ensures everyone is working from the same definitions and numbers. Without this foundation, more advanced AI introduces noise rather than insight.

What AI-Powered Analytics Delivers

AI-powered analytics transform financial data into decision-ready intelligence. Real-time dashboards provide a clear view of performance as conditions change, while predictive models surface trends before they escalate into issues. Automated anomaly detection highlights unusual transactions, reducing manual effort and improving response times.

These systems also enable continuous risk monitoring across portfolios, products, and customers. Patterns in customer behavior become easier to spot, supporting retention and personalization strategies.

Governance, access control, and data security should be built into the analytics layer, helping institutions meet regulatory and internal compliance requirements from the start.

Use Cases in Financial Services

AI-powered analytics support core banking and financial operations, including:

- Retail banking: Transaction pattern analysis, churn prediction, and real-time AI banking alerts.

- Investment management: Portfolio performance tracking and market trend analysis.

- Corporate banking: Predictive credit risk assessment and loan performance monitoring.

- Compliance: Automated regulatory reporting and scalable suspicious activity monitoring.

Each use case relies on explainable analytics rather than autonomous decision-making.

Why This Level Matters

AI-powered analytics create the conditions required for every higher level of AI maturity. It delivers quick ROI through automation, builds confidence in AI-driven insights, and establishes the governance frameworks needed for conversational and generative AI later.

Level 2: AI Chatbots: Automating Customer Interactions

AI chatbots are often the first visible use of AI in a customer’s digital banking journey. They typically handle routine, repeatable inquiries, allowing human agents to focus on complex, high-value conversations.

At this level, AI is still reactive. Chatbots respond to customer questions, but they do not reason deeply or make decisions independently.

When implemented correctly, AI banking chatbots reduce wait times, improve consistency, and lower support costs without changing core processes.

How AI Chatbots Work in Banking

Banking AI chatbots rely on a combination of language understanding, system integration, and controlled workflows.

Natural language processing allows the bot to interpret customer questions and map them to known intents. Integration with core banking systems enables access to account data, transaction history, and service status.

Conversations follow predefined paths designed around common requests. When a question falls outside those boundaries, the chatbot escalates the interaction to a human agent.

Most banking AI chatbots operate continuously and are deployed across multiple channels, including web portals, mobile apps, and messaging platforms.

Top Use Cases for Banking AI Chatbots

AI chatbots are most effective when applied to frequent, low-complexity requests:

- Account management: Balance checks, transaction history, statement requests.

- Customer support: Password resets, card activation, branch and ATM locations.

- Loan services: Application status updates, payment reminders, basic eligibility questions.

- Fraud alerts: Suspicious transaction notifications, card blocking requests.

- Product information: Interest rates, fees, and product comparisons.

These use cases reduce call volumes while maintaining consistent service.

Benefits and Limitations

AI chatbots provide 24/7 availability, instant responses, and scalable customer support at a lower cost per interaction. However, they are limited to predefined scenarios and often struggle with complex, emotional, or ambiguous situations.

For this reason, the most effective banking AI chatbot deployments combine automation with easy handoff to human agents. This hybrid approach protects the customer experience while maximizing efficiency.

Level 3: Conversational AI & Copilots: Intelligent Collaboration

Conversational AI and copilots move banking AI beyond simple question-and-answer interactions into context-aware collaboration. They understand intent, remember prior interactions, and support multi-step workflows, making them suitable for more complex customer and employee needs.

At this level, AI works alongside people rather than replacing them. Copilots assist employees in real time by surfacing relevant data, suggesting next steps, and highlighting risks or opportunities.

Conversational AI can support financial services organizations with meaningful gains in productivity and customer experience without introducing high operational risk.

- Context awareness: Remembers previous interactions and customer history.

- Multi-turn dialogue: Handles conversations that require back-and-forth clarification.

- Personalization: Adjusts responses based on customer profiles and behavior.

- Deeper integration: Pulls data from multiple systems to provide complete answers.

- Learning capability: Improves recommendations over time based on usage.

These features make conversational AI for financial services better suited to advisory and support roles.

Copilot Applications in Financial Services

Copilots are designed to augment professional judgment in regulated environments:

- Loan officers: Surface relevant customer data, suggest suitable loan products, and flag risk indicators.

- Wealth advisors: Support investment recommendations based on goals, risk tolerance, and market conditions.

- Customer service representatives: Provide real-time solution suggestions, policy references, and next-best actions.

- Compliance officers: Assist with document review by flagging potential issues for human verification.

- Credit analysts: Support risk assessments with explainable recommendations.

Each use case emphasizes guidance rather than automation.

The Human-AI Partnership Model

Conversational AI and copilots provide speed, consistency, and insight, while employees retain decision authority. This approach builds trust in AI systems, supports customer engagement, and preserves the personal interactions customers expect. It also prepares organizations for more autonomous AI by first establishing confidence, governance, and accountability.

Level 4: Generative AI Agents: Solving Complex Problems

Generative AI agents go beyond conversation by analyzing information, generating insights, and completing multi-step tasks. Unlike chatbots or copilots, these systems are designed to work with complex inputs and produce structured outputs that support real business decisions.

Gen AI agents can read unstructured data, connect it with structured analytics, and produce explanations or recommendations in human-readable form.

At this level, AI does not operate independently. Humans remain responsible for approvals and outcomes, but much of the heavy analytical and documentation work is automated.

What Makes Generative AI Different

Generative AI agents introduce capabilities that earlier AI levels cannot deliver:

- Content generation: Produces reports, summaries, investment memos, and risk assessments.

- Data synthesis: Combines information from multiple systems into actionable insights.

- Scenario analysis: Models outcomes under different assumptions and market conditions.

- Document processing: Extracts and analyzes data from contracts, statements, and filings.

- Personalization at scale: Delivers tailored recommendations to thousands of customers at once.

These capabilities reduce manual effort while improving consistency.

Generative AI Use Cases in Banking and Fintech

Generative AI use cases in banking span multiple functions:

- Investment management: Automated research reports, personalized portfolio recommendations, and stress testing.

- Loan processing: Document review, credit assessment report generation, and personalized loan offers.

- Customer retention: Predictive churn analysis, tailored product recommendations, and automated outreach.

- Fraud detection: Transaction pattern analysis, anomaly explanations, and investigation reports.

- Regulatory compliance: Policy analysis, compliance reporting, and risk documentation.

- Payment services: Dispute resolution support, payment trend forecasting, and fraud detection in payment flows.

These use cases demonstrate how gen AI fintech solutions scale expertise across teams.

Governance and Explainability Requirements

In financial services, generative AI must be explainable: institutions need to understand how outputs are generated, maintain audit trails, and ensure strict human oversight. Data security, privacy controls, and model transparency are non-negotiable. Without strong governance, the risks of generative AI outweigh the benefits.

Level 5: Autonomous Agentic AI: The Future of Smart Financial Operations

Autonomous agentic AI represents the most advanced stage of AI, where systems can perceive conditions, make decisions, and take action with minimal human involvement. These agents operate continuously, responding to real-time signals and executing predefined actions based on rules, objectives, and learned patterns.

What Defines Agentic AI

Agentic AI systems differ from earlier AI approaches because they are built to act, not just advise. These characteristics distinguish autonomous agents from generative or conversational AI:

- Autonomy: Handles routine decisions and actions without human input.

- Goal-oriented behavior: Optimizes toward defined objectives such as return, risk, or efficiency.

- Adaptability: Learns from outcomes and adjusts strategies over time.

- Multi-agent coordination: Multiple agents collaborate across complex workflows.

- Continuous operation: Monitors environments and responds 24/7.

Agentic AI Applications in Financial Services

Early deployments of AI agents in banking focus on high-volume, rules-driven processes:

- Portfolio management: Autonomous rebalancing, tax-loss harvesting, and position sizing.

- Risk management: Real-time exposure monitoring, automated hedging, and risk limit enforcement.

- Fraud prevention: Continuous transaction monitoring, pattern investigation, and rule optimization.

- Customer journey optimization: Automated next-best actions, real-time personalization, proactive outreach.

- Regulatory compliance: Ongoing regulatory monitoring, automated control testing, transaction surveillance.

These use cases show how agentic AI scales decision-making across corporate, investment, and retail operations.

How to create an AI agent in a data intelligence platform

Guardrails and Human Oversight

Agentic AI systems require strict boundaries, escalation rules, and continuous supervision. The goal of agentic AI in financial services is autonomy with oversight, not “set and forget.” Institutions that treat it as a controlled evolution, rather than a replacement for governance, are best positioned to realize its benefits safely.

Choosing the Right AI Level for Your Organization

Most financial institutions do not move directly to autonomous AI (trying to do so often creates more risk than value).

Successful AI adoption depends on matching the level of AI sophistication to an organization’s readiness across data, technology, regulation, and people. The right choice is not about what is technically possible. It is about what is practical, safe, and aligned with business goals.

Many AI initiatives in financial services fail because they are misaligned with reality. Choosing the right level requires an honest assessment of where you are today and what you are prepared to support tomorrow.

Assessment Framework

A clear assessment framework can help an organization avoid overreach and under-delivery.

- Data readiness determines what AI can realistically achieve. Clean, well-governed data must be accessible across systems, with strong security and privacy controls in place.

- Use case clarity is equally important. Teams should define specific problems, agree on success metrics, and secure stakeholder buy-in before selecting AI tools.

- Technical capability sets practical limits. This includes in-house AI or analytics expertise, infrastructure that can support AI workloads, and the ability to integrate with existing systems.

- Regulatory constraints shape every decision. Financial institutions must understand explainability requirements, human-in-the-loop obligations, and audit expectations before moving beyond assistive AI.

For more on this, watch this video about what it takes to make analytics reliable and AI-ready at scale.

Recommended Implementation Pathway

Most organizations see the best results by following a staged approach:

- Begin with AI-powered analytics to establish a trusted, governed data foundation and consistent metrics.

- Introduce AI chatbots for contained, low-risk customer interactions and early efficiency gains.

- Expand to conversational AI and copilots as teams gain confidence using AI in daily workflows.

- Apply generative AI agents to complex, high-value problems that require synthesis, reasoning, and scale.

- Evaluate autonomous agents only after earlier stages are stable, governed, and well understood.

At every step, security, governance, and compliance must remain constant. Teams considering generative or agentic AI should also understand the technical and governance requirements involved in building agents responsibly.

Real-World Impact: Success Metrics Across AI Levels

Different AI levels deliver different types of business impact, from efficiency gains to revenue growth and risk reduction. Understanding what success looks like at each stage helps financial institutions set realistic expectations, measure ROI, and avoid judging advanced AI initiatives by the wrong standards.

Early AI investments tend to deliver operational improvements, such as faster reporting and lower service costs. As AI maturity increases, the impact shifts toward customer engagement, decision quality, and long-term efficiency.

This progression is why AI automation success stories in financial services often look very different depending on where an organization starts.

Key Performance Indicators by AI Level

The table below shows how success metrics evolve across the five levels of AI:

| AI Level | Strategic Value Drivers | Predicted Impact |

|---|---|---|

| AI-Powered Analytics | Report generation time, data access speed, insight accuracy |

60–80% reduction in reporting time through automated data ingestion. |

| AI Chatbots | Response time, resolution rate, cost per interaction | |

| Conversational AI | Customer satisfaction, employee productivity, conversion rates | |

| Generative AI Agents | Processing time, accuracy, decision quality |

50–70% reduction in manual work for investigations and compliance filing. |

| Autonomous Agentic AI | ROI, error rates, continuous improvement rate |

40–80% productivity uplift in autonomous credit and risk workflows. |

Why GoodData Is the Right Choice for AI in Financial Services

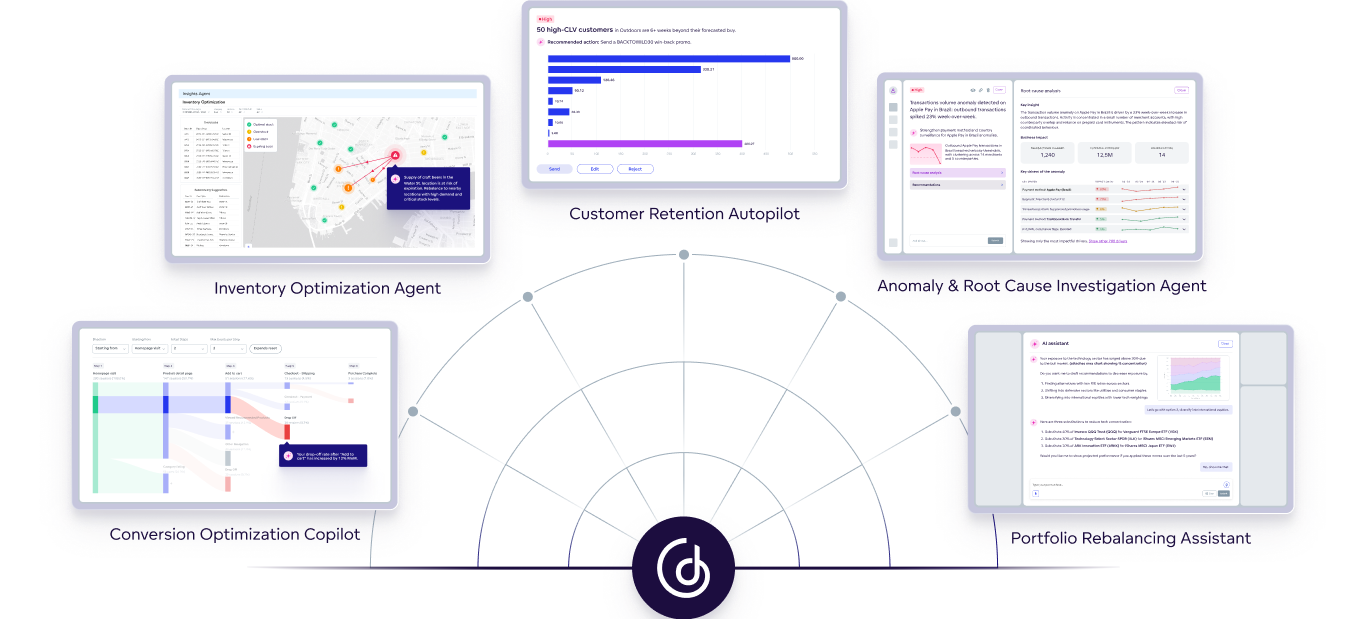

GoodData provides a data intelligence platform built for the financial services industry. It gives financial institutions a single foundation for analytics, conversational AI, generative AI, and autonomous agents, without stitching together multiple tools.

The agentic platform is designed for embedded AI in client-facing applications, making it easier to deliver insights and automation directly inside banking, fintech, and payment products. Security, governance, and flexibility are built in from the start, so teams can innovate without compromising compliance.

GoodData provides everything an organization needs for successful AI implementation

GoodData’s Agentic AI Platform for Financial Services

GoodData supports every stage of AI maturity:

- AI-powered analytics that create a semantic data layer you can trust.

- Conversational AI assistance for natural language data access.

- Generative AI capabilities for insight generation and decision support.

- Agentic AI framework for autonomous, rules-based operations.

Book a demo to learn more about how GoodData supports AI across the entire maturity spectrum.

Frequently Asked Questions About AI in Financial Services

The best AI solution depends on your goals and readiness. Most institutions start with AI-powered analytics, then add chatbots, conversational AI, or agents. A strong platform combines automation, governance, security, and scalability so AI can grow safely across use cases.

Top AI agents include autonomous decision-making for routine tasks, goal-based optimization, continuous operation, audit trails, and explainability. Enterprise-grade security, data governance, and human oversight are essential features to meet regulatory and risk management requirements.

AI chatbots help banks handle high volumes of customer inquiries quickly and consistently. They automate routine customer service tasks such as balance checks, password resets, and fraud alerts, improving response times while freeing human agents for complex interactions.

The best AI chatbots for retail banking integrate securely with core banking systems, support multiple channels, and escalate smoothly to human agents. Effectiveness matters more than brand names, especially accuracy, reliability, and a consistent customer experience.

The best AI-powered banking assistant combines conversational AI with real-time data access and governance. It should support customers or employees with clear answers, personalized guidance, and explainable recommendations while operating securely within banking compliance standards.

AI reduces operational costs by automating repetitive tasks, shortening processing times, and improving accuracy. Analytics cut reporting effort, chatbots lower support costs, and AI agents reduce manual reviews, allowing teams to focus on higher-value work.

AI in banking can be safe when built on secure infrastructure with strong data governance. Encryption, access controls, audit trails, explainability, and human oversight are critical to managing cybersecurity, compliance, and operational risk.

AI is more likely to augment employees than replace them. Most banking AI systems support decision-making, automate routine work, and improve productivity, while humans remain responsible for judgment, customer relationships, and regulatory accountability.

Implementation time varies by AI level. Analytics and chatbots can be deployed in weeks or months, while generative or autonomous systems take longer due to data readiness, integration, governance, and regulatory review requirements.

AI in banking is governed by existing financial regulations, data protection laws, and emerging AI standards. Key requirements include explainability, auditability, data privacy, risk management, and human-in-the-loop controls, depending on region and use case.