Why Read This Playbook?

AI has the potential to reshape how banks, fintechs, and payment providers operate. Yet most institutions are still stuck in pilot mode. They know that AI matters, but struggle to scale it.

This playbook is designed to help. It shows you how to:

- Understand the barriers holding back AI adoption.

- Build the right foundation with AI-ready analytics.

- Apply AI in practice with autonomous agents.

If you’re a CIO, innovation lead, or data leader, this guide provides a clear path to practical, compliant, and profitable agentic AI.

Step 1: Understand the Challenge

The biggest barriers to capitalizing on AI's promise aren’t a lack of ideas or ambition; they’re legacy systems, fragmented data, and strict compliance requirements.

Legacy systems

Most core banking and payment platforms weren’t designed for today’s data-driven world. Data is often locked inside these systems, making it costly and complex to access. This slows AI innovation and puts traditional players behind fintech challengers.

Data fragmentation

Even when data is accessible, it is scattered across many systems: CRM, fraud detection, compliance, payments, and more. Without integration, analytics and AI cannot deliver their full value. The result is limited personalization and long delays in bringing new services to market.

Compliance pressure

Any AI initiative that involves financial data must meet strict rules for privacy, explainability, and bias monitoring. These essential safeguards create extra cost and complexity. Moving too slowly increases the risk of losing ground to competitors, while moving too fast risks reputational damage.

The opportunity window

According to NVIDIA, 98 percent of financial firms plan to increase AI investment in 2025. Early adopters are already seeing results. Klarna’s AI assistant handled 2.3 million customer conversations in its first month — the equivalent of 700 full-time agents. Digital-first bank TBC Uzbekistan found that customers can’t tell its AI-powered payment reminder calls from human ones, while the AI is ten times more cost-efficient. The window for action is open, and those who overcome the barriers to AI implementation will set the pace for the industry.

Step 2: Build the Foundation — The Role of an AI Analytics Platform

Most failed projects share the same cause: data is scattered, poorly governed, or not fit for AI use. Without trusted analytics, AI quickly becomes risky or ineffective.

According to Gartner, capitalizing on the potential of agentic AI requires high-quality, AI-ready data. Research from MLQ.ai shows that 95 percent of AI projects fail without proper workflow integration and context. The right platform addresses both challenges.

Four essential capabilities of an AI analytics solution

An AI analytics platform unifies and governs data across systems, makes information available in real time, and provides the trust layer that regulators, boards, and customers expect. Just as important, it gives organizations the ability to build and embed fully autonomous AI agents directly into workflows and applications.

The platform’s ability to build and deploy agents is the true marker of AI maturity. It opens the door not only to internal efficiencies but also to monetization, as customer-facing agents can be embedded into products and offered directly to clients.

To succeed, your data intelligence platform must have:

- Unified data layer: Brings together data from core banking, CRM, payments, fraud, and compliance systems. This creates a single source of truth and removes silos that slow down AI adoption.

- Enterprise-grade governance and compliance: Provides explainability, anonymization, and bias monitoring. Audit trails and secure deployment patterns, such as zero data retention, help to satisfy regulators and protect sensitive customer information.

- Real-time data processing: Capable of working with structured and unstructured data, both batch and streaming. This powers real-time use cases such as fraud detection, risk scoring, and liquidity management.

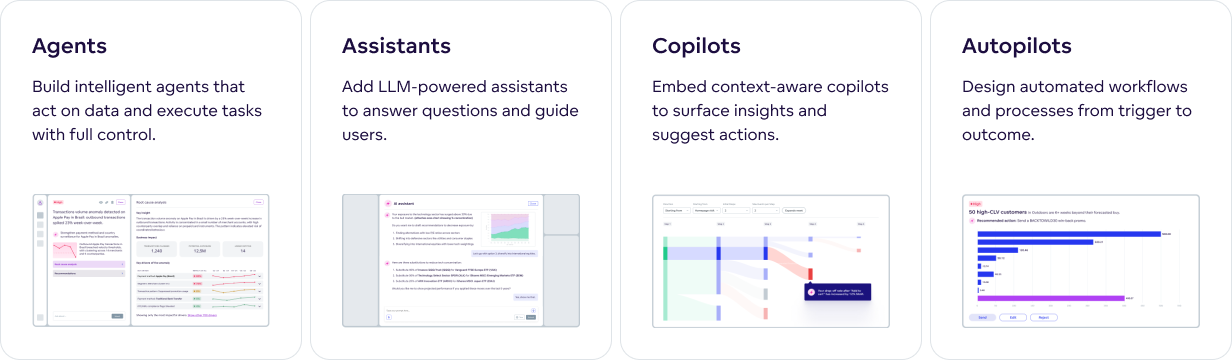

- Agentic readiness: Supports the progression from dashboards to assistants, copilots, and fully autonomous autopilots. An AI platform should allow organizations to build and embed agents directly into workflows, allowing them to move beyond static analytics to proactive, agent-driven operations.

H2: Step 3: Apply AI in Practice — From Dashboards to Agents

In this section, we will look at how AI is already used in financial services and then take it a step further with agentic AI. You will see how organizations can move from typical use cases, like customer service and fraud detection, to embedded agents that act on insights in real time.

Examples of Typical AI Use Cases in Financial Services

Banks and payment providers are already using AI in customer service, risk management, and fraud detection. These remain the most common applications today, though progress often stalls without a solid data foundation.

- Customer engagement: Conversational AI can handle routine service tasks such as authentication, intent recognition, and transaction processing. It can also identify missing inputs and escalate complex issues, like card disputes, to a human agent.

- Risk and credit: AI can automate credit risk scoring to speed up loan approvals. It also supports financial forecasting, real-time cash positioning, and fund allocation adjustments.

- Fraud and AML: AI can detect and flag suspicious activity, helping prevent fraud before it escalates. It can also identify AML patterns while maintaining audit trails that meet compliance requirements.

Examples of Agentic AI in Financial Services

Traditional dashboards show what’s happening; agentic AI goes a step further by taking action. With a solid data foundation, AI agents can detect problems, conduct investigations, and even draft compliance-ready reports.

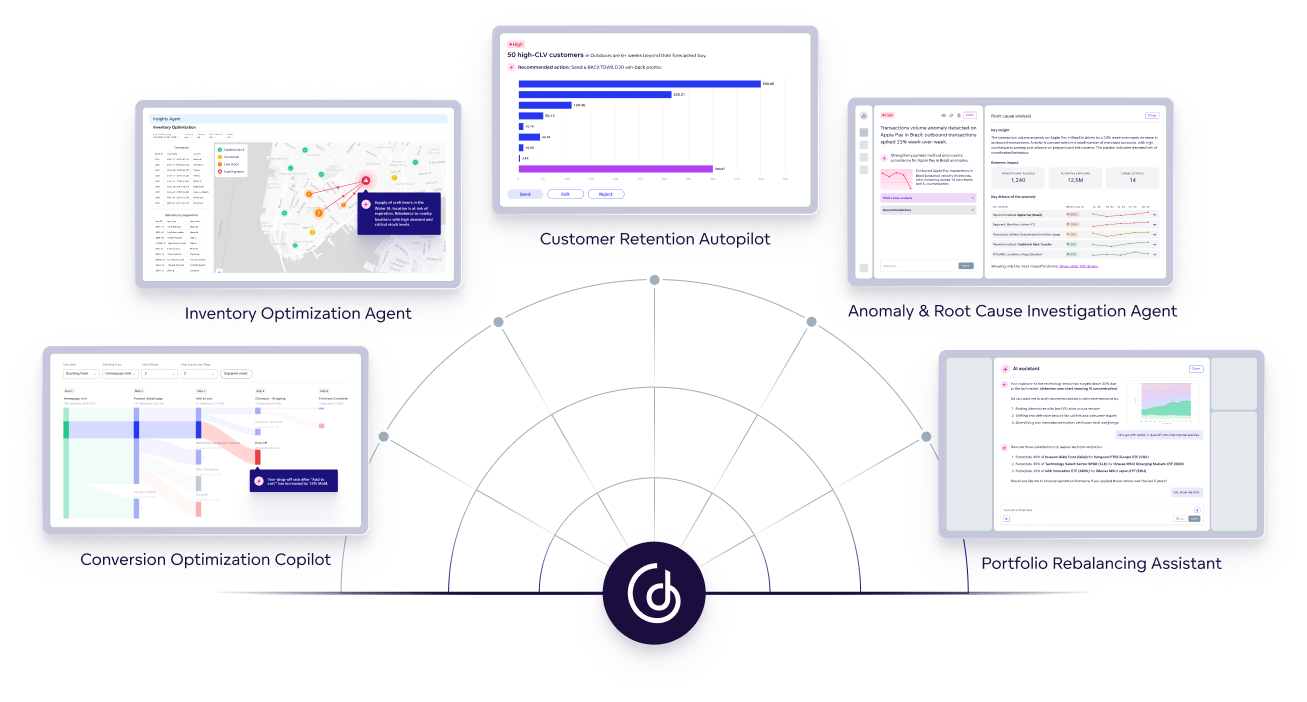

The examples below illustrate how agents can turn a static analytics tool into an active partner.

- Fraud and compliance: A transaction monitoring dashboard can highlight unusual activity, but a Fraud Scenario Miner can analyze patterns, discover new fraud typologies, and draft updated rules after backtesting them.

- Anomaly detection: A corridor or velocity dashboard can flag unusual transactions, but an Anomaly & Root Cause Investigation Agent can investigate root causes, link related entities, and prepare compliance-ready case summaries.

- Merchant risk management: A dashboard might show merchant exposure, but a Merchant Risk Tiering Autopilot can recalibrate risk tiers, recommend enhanced due diligence, and even propose offboarding lists.

- Capital markets and portfolio management: Performance dashboards can reveal what happened in the market, but a Portfolio Rebalancing Agent can go further by suggesting rebalancing trades that comply with mandates, tax, and liquidity constraints. It can also provide interactive recommendations through a chat-style interface.

- Financial reporting: A KPI dashboard might highlight variances in shareholder reports, but a Narrative Copilot can draft explanations, MD&A-style commentary, and board-ready insights with cited drivers.

Conclusion: Making AI Practical, Profitable, and Compliant

The opportunity for AI in financial services is clear, but so is the risk of failure. A recent MIT study found that 95 percent of generative AI pilots fail because companies use the wrong technology or avoid tackling the hard integration work.

Done wrong, AI projects stall, add costs, and expose firms to compliance risks. Done right, they lower the cost of control, speed up product launches, and deliver the kind of secure, personalized services customers now expect.

With the right data intelligence platform, banks and payment providers can move past pilots and start making AI agents a trusted part of everyday business.

Discover Your Data Goldmine with Embedded AI Agents

GoodData is built for financial services organizations and fintechs that want faster, safer, embedded agentic AI. It is not about flashy prototypes. It is about tools and architecture that work in real settings, helping you improve operations and monetize data by embedding customer-facing agents into products and services.

Reasons our customers choose GoodData include:

- Embedded agentic AI: GoodData is designed to build agents, copilots, and automated workflows, and embed them directly into applications and business processes.

- Flexible, composable architecture: GoodData provides a suite of developer tools, APIs, and an AI lake. You can build on what already works, adapt quickly, and avoid being locked in.

- Security and compliance by default: GoodData supports trusted deployment models, zero data retention, strong privacy, and controls that meet regulatory demands.

- Real speed to value: Because it is built to integrate, scale, and embed AI agents, implementation can happen much faster. You can test, deploy, and iterate without long lead times.

Ready to see it in action? Request a demo.

Continue Reading This Article

Enjoy this article as well as all of our content.

Does GoodData look like the better fit?

Get a demo now and see for yourself. It’s commitment-free.