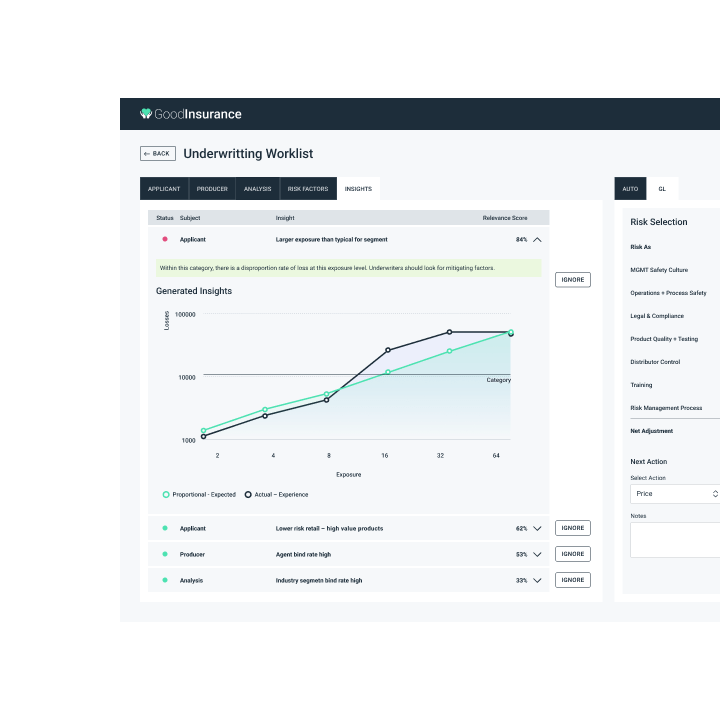

Underwriting insights

Enabling faster, integrated, and profitable underwriting decisions.

Key features

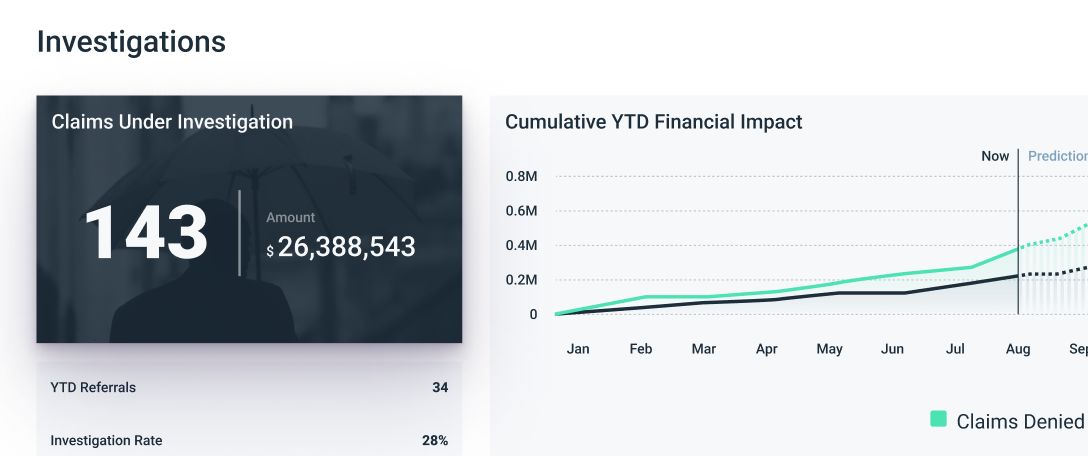

Submission insights

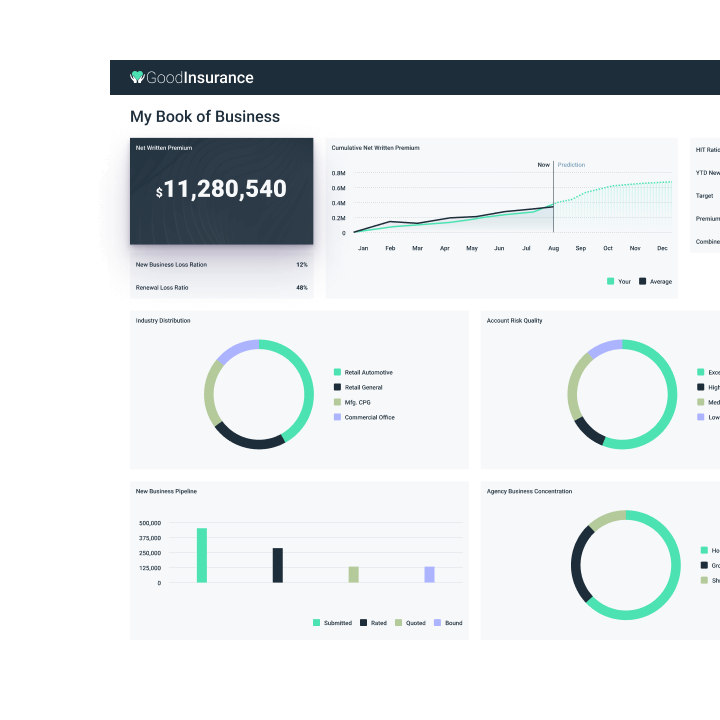

My book of business

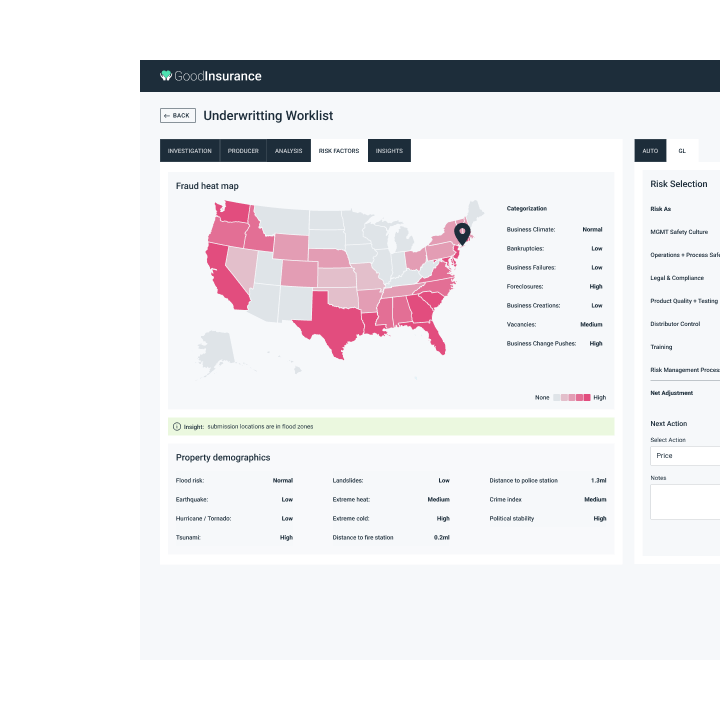

Risk insights

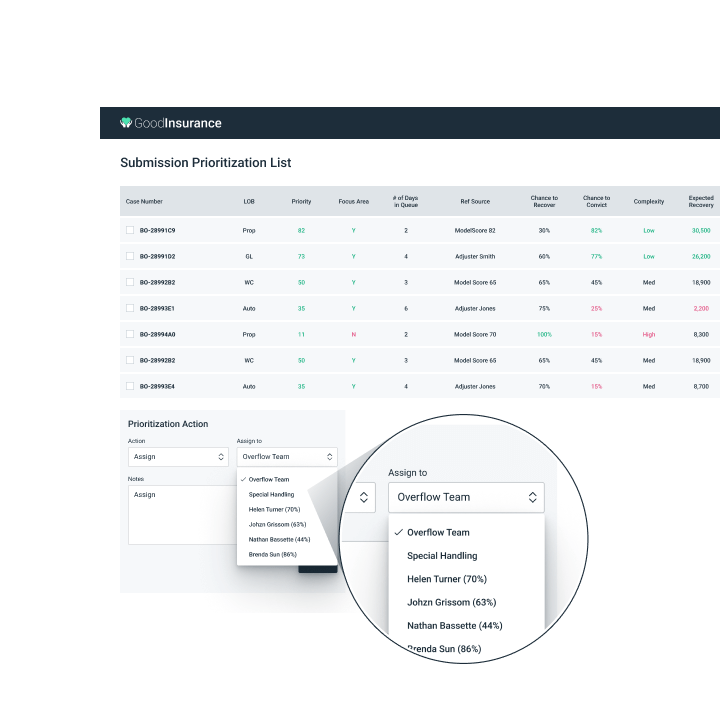

Decision guidance

Underwriters often spend

IBM, “Reinventing Risk Management”

50% or more time gathering information

Insurance underwriting involves making decisions that are high-impact yet complex in nature. The majority of the time, however, underwriters are too busy trying to search, access, aggregate and understand information to gain real insights that can assist with decision-making. Underwriters are spending more time in administration than in making better risk and profitable decisions for the organization..

For insurers to become agile, profitable and capture market share, they need to help their underwriters reduce administrative burden and focus on high-value tasks like risk assessment and profitable pricing. The future Underwriter “will be an integrated profit-and-loss professional assisted by automated and analytics-based decision-making system” (Gary Plotkin, KPMG’s Insurance Principal). GoodData enables this transformation.

GoodData solution

The GoodData Underwriting Insights is a solution developed on GoodData's Enterprise Insights PaaS. It is unique and offers several compelling benefits.

Bring data together

Aggregates data from multiple sources into a single repository for faster access and deployment flexibility

Integrate into workflows

Sits on top of multiple existing workflow systems and presents a unified analytics experience

Deploy your own models

Deploys advanced analytics models within the platform to deliver predictive insights across the decision flow

Highly customizable

Provides customizable user experiences, flows, analytical models, visualizations & data sources allowing for a solution that meets your unique needs

GoodData Demo

Get a guided tour and ask us about GoodData’s features,

implementation, and pricing.

A trusted platform, loved by users