Sales Forecasting: A Complete Guide for Businesses

What Is Sales Forecasting and Why It Matters

Sales forecasting is the process of estimating future revenue based on past data, current trends, and market conditions. At its core, it helps you answer a crucial question: How much are we likely to sell in the next month, quarter, or year?

Done well, sales forecasting gives businesses the confidence to make informed decisions across almost every function. It guides them on how much stock to order, how many people to hire, and where to focus marketing spend. The impact can be significant, with 97% of companies that implement best-in-class forecasting processes achieving their quotes.

And the benefits aren’t just internal. Accurate forecasts increase trust with investors, help secure funding, and improve communication across departments. Everyone from marketing to operations benefits from having a shared view of the future.

Who Is Responsible for Sales Forecasting?

Sales forecasting is often seen as the job of the sales team, but in reality, it is a shared effort. Sure, a sales team can bring frontline knowledge as they understand which deals are likely to close, where risks lie, and how buyers respond. But other teams play critical roles in shaping, validating, and using the forecast to make business decisions.

Revenue operations (DevOps), for example, own the systems and workflows behind the sales process. They define pipeline stages, enforce deal-tracking standards, and make sure the data remains clean. Traditionally, this required ongoing effort, but with a data analytics platform or sales forecasting software in place, many of these tasks become automated. Once RevOps sets the business logic (like opportunity weightings or sales-readiness criteria), the forecast runs automatically using live CRM data.

Data and BI teams also play a key role in building and maintaining the forecasting engine. They connect data sources, create models, and deliver dashboards to stakeholders. That said, one of the biggest advantages of modern analytics solutions is their ability to handle much of the heavy lifting — ingesting data, applying predictive models, and enabling even non-technical users to create visualizations and dashboards. (To see what’s possible, explore various sales dashboard examples here). Such solutions free up data teams to focus less on routine reporting and more on refining models and supporting strategic analysis.

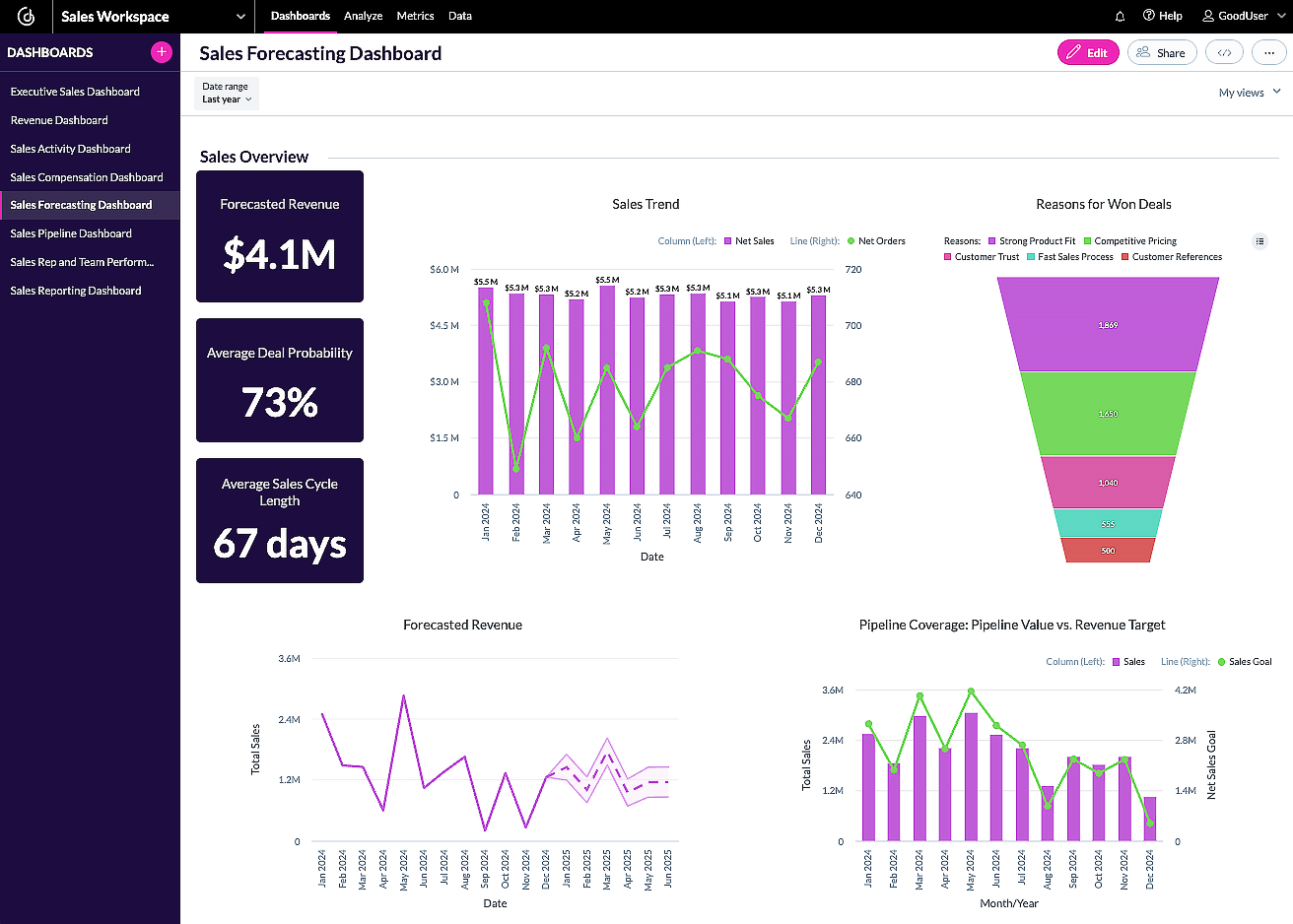

Example of a sales forecast in an analytics platform

Sales Forecasting Methods and Models

Although a growing number of companies use analytics tools to bring their data together, understanding the different forecasting models is still important, especially when reviewing results or building buy-in with leadership.

Let’s walk through the two main types of forecasting methods and how they’re used in practice.

1. Quantitative Forecasting Techniques

These methods are based on historical data and look at past performance to estimate what might happen next:

- Time Series Model: Uses trends and seasonality from past sales data to predict future performance.

- Regression Analysis: Shows how different factors (like pricing, marketing spend, or region) impact sales.

- Historical Sales Average: A simple model that uses average past performance as a baseline for future sales.

- Multivariable Analysis: Combines multiple inputs to create a more refined prediction; this is often used when sales depend on several factors at once.

Note: The above methods are useful when a business has stable operations and reliable historical data.

2. Qualitative or Judgment-Based Techniques

These models rely on human input and experience. They’re often used when data is limited or when entering new markets where past performance is not a good indicator of the future.

Examples include:

- Rep Forecasting: Sales reps estimate what they expect to close based on current conversations.

- Opportunity Stage Forecasting: Each deal in the pipeline is given a probability to close based on how far along it is.

- Lead Scoring Models: Leads are assigned value based on behavior or engagement level.

- Sales Cycle Length Forecasting: Predictions are based on how long deals typically take to close in your business.

Note: These techniques can introduce bias, but they’re still valuable. Many teams use them alongside quantitative models for a more complete picture.

Quick Comparison of Sales Forecasting Methods

For reference, we've compiled a table of the different methods, when it is best to use each of them, the data required, and the main benefits.

| Forecasting Method | Best Use Case | Data Needed | Key Benefit |

|---|---|---|---|

| Time Series | Seasonal or trend-driven sales cycles | Historical sales data | Captures patterns and seasonality |

| Regression Analysis | Understanding impact of marketing, pricing, or other factors | Sales plus external variables | Explains what drives sales changes |

| Historical Average | Quick baseline estimates for stable sales | Historical sales data | Simple and fast to apply |

| Multivariable Model | Complex sales influenced by many factors | Sales, marketing, operations data | More accurate with multiple inputs |

| Rep Forecasting | Early-stage or small teams, subjective insights | Pipeline and rep feedback | Adds real-time deal context |

| Opportunity Stage Model | B2B sales with clear sales pipeline stages | CRM deal data | Quantifies deal progress |

| Lead Value Model | High-volume inbound leads | Lead scoring, engagement data | Prioritizes leads by potential value |

| Sales Cycle Length Model | Predicting deal closure timing | Historical sales cycle data | Helps forecast timing and cash flow |

How to Create a Sales Forecast (Step-by-Step)

A reliable sales forecast isn’t just about plugging numbers into a spreadsheet. The steps below will help you build a forecast that your whole team can stand behind.

Step 1: Define Your Goals and Timeframe

Start by deciding what you’re forecasting and for how long. Are you estimating revenue for next quarter? Setting targets for the next 12 months? Forecasts can be short-term (weekly or monthly) or long-term (annual or multi-year), depending on your planning needs.

Clear goals help you decide what data to use and which forecasting method is best. For example, if you're planning for inventory, you may need more granular short-term data. If you’re budgeting for next year, a higher-level annual forecast might be enough.

Step 2: Gather Historical Sales Data

Look at past sales to identify patterns and trends. At a minimum, collect:

- Revenue by product or service

- Number of deals closed

- Average deal size

- Sales by region or rep

Note: The more consistent and clean your data, the more accurate your forecast will be. Use your CRM, accounting system, or sales analytics software to pull this data.

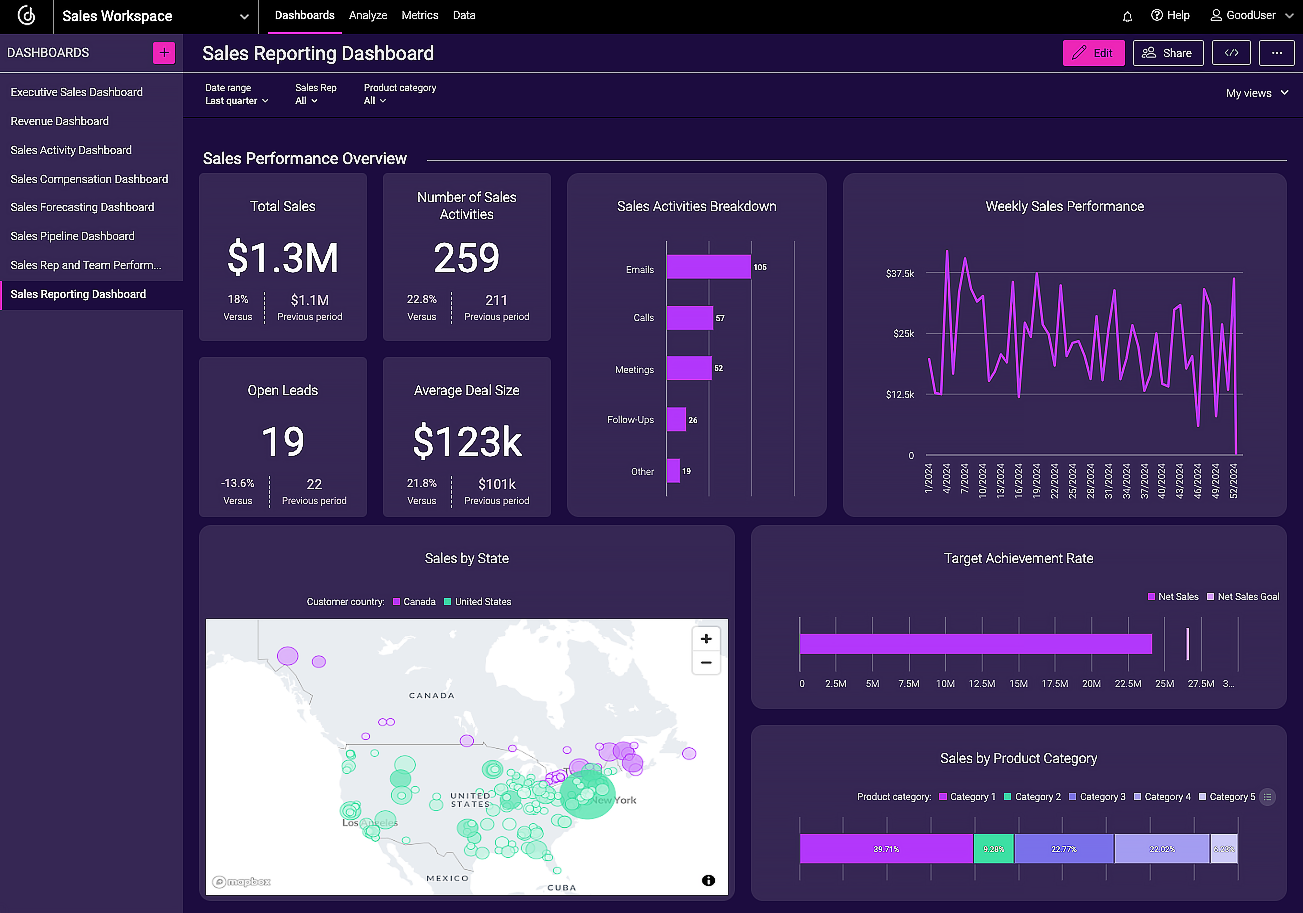

A sales reporting dashboard unifies historical data

Step 3: Choose the Right Forecasting Method

Use what you've learned about your sales history to pick a method (or combination of methods). As mentioned earlier, if you have reliable historical data, a quantitative model like time series or regression may work well. If you’re launching a new product or entering a new market, you might rely more on rep estimates or opportunity-stage models. Most businesses use a blend of both quantitative and qualitative models.

Step 4: Factor in Market Trends, Seasonality, and Business Cycles

Sales don’t exist in a vacuum. External factors like economic conditions, industry trends, and customer behavior can all influence your numbers. Make sure to adjust your forecast based on:

- Expected seasonality (e.g., holiday surges or summer lulls)

- Market changes (e.g., new competitors or shifting demand)

- Internal shifts (e.g., pricing updates, product launches, or staffing changes)

- This step helps you stay realistic rather than relying purely on past trends

This step helps you stay realistic rather than relying purely on past trends.

Step 5: Review and Validate with Stakeholders

Once your initial forecast is built, review it with key stakeholders, such as sales leaders, finance, RevOps, and others. They can help validate assumptions, challenge unrealistic numbers, and offer insight from their part of the business.

Step 6: Update Regularly

Forecasting is not a one-and-done exercise. New data comes in constantly, deals move, market conditions shift, and strategies evolve. Set a regular cadence to review and update your forecast, whether weekly, monthly, or quarterly.

Note: If you’re using a modern BI platform, many of these updates can be automated as new CRM data flows in.

Measuring and Improving Sales Forecast Accuracy

When your sales forecast is off, it can cause all kinds of problems, like hiring too many people, ordering too much stock, or missing your revenue goals. That’s why the importance of tracking sales forecast accuracy can’t be overstated. It shows how close your predictions are to what actually happened and helps you spot areas to improve.

Key numbers to track:

- Forecast Accuracy: How close your forecasted sales were to actual results. For reference, analysts indicate that, on average, companies hit between 70% and 79% accuracy.

- Win Rate: The percentage of forecasted deals that actually close. If it's low, your team might be too optimistic.

- Deal Slippage: How many deals were expected to close but didn’t. High slippage means your pipeline might not match reality.

Another simple way to improve accuracy is to use clean and reliable sales data. An analytics platform can connect these models, but your team still needs to agree on how deal stages are defined and tracked. Remember, even the best models and tools won’t help if your inputs are off.

How Different Industries Approach Sales Forecasting

Sales forecasting isn’t one-size-fits-all. Every industry has its own sales rhythms, data sources, and external influences, so the forecasting methods naturally vary. What works for a SaaS company might fall flat in retail or pharmaceuticals. That’s why it’s important to understand how different sectors approach sales forecasting based on the nature of their products, customer behaviors, and data maturity.

For example:

B2B SaaS companies often rely on CRM-driven forecasts, using opportunity stages, lead scoring, and rep input. Subscription models make it easier to predict renewals, but new business forecasting depends heavily on pipeline quality and deal velocity.

Retail businesses typically use time-series models to forecast based on historical sales, seasonality, and inventory turnover. External factors like holidays, promotions, and even weather can significantly impact accuracy, so real-time data and POS integrations are key.

Pharmaceutical companies work with longer sales cycles, regulatory constraints, and limited historical launch data. Forecasts often combine market research, physician adoption models, and scenario planning to estimate demand.

Common Sales Forecasting Challenges and How to Overcome Them

Even the best forecasting models can fall short if the underlying data or process isn’t sound. A common issue is over-reliance on gut feeling: forecasts built on intuition rather than data often miss the mark. While sales reps’ input is valuable, it should be balanced with objective metrics.

Other roadblocks include incomplete or messy CRM data, poor pipeline hygiene, and unrealistic deal inputs. If reps don’t regularly update deal stages or overestimate close probabilities, the forecast quickly loses credibility.

To overcome these challenges, invest in data cleanliness, define clear forecasting rules, and use tools that automatically flag inconsistencies.

Today’s Top Trends in Sales Forecasting

Sales forecasting is undergoing a major shift from spreadsheets and static dashboards toward more dynamic, AI-enhanced processes that give teams faster, smarter answers.

One of the biggest changes is how machine learning (ML) is being used behind the scenes. Instead of relying solely on historical trends or rep inputs, newer forecasting systems automatically adjust as conditions change, whether that’s a deal slipping in the pipeline, a shift in buyer behavior, or a new market signal. These systems learn as they go, improving forecast accuracy over time with little to no manual input.

Large Language Models (LLMs) are also changing how teams interact with forecasts. Instead of digging through dashboards, sales leaders can simply ask questions—like “What changed in the pipeline this week?”—and get a clear, conversational response. This opens up insights to more people than just data experts.

Get Started with Sales Forecasting Today

By now you’ve probably realized that accurate sales forecasting can help your businesses plan smarter, grow faster, and make more confident decisions.

The right approach makes all the difference, from choosing the right model to using real-time data and cross-team collaboration. GoodData gives you the tools to turn raw sales data into clear, actionable insights without the manual work. Request a personalized demo to see how the platform can help you meet your analytics goals.

FAQs About Sales Forecasting

AI improves accuracy by spotting patterns in large datasets, adjusting forecasts in real time, and reducing human error.

Sales forecasting predicts revenue based on pipeline and historical performance; demand forecasting estimates customer need for a product.

Use market research, competitor benchmarks, and judgment-based models until enough data is available for quantitative forecasting.

Excel works for basic forecasts, but it lacks automation, real-time updates, and integration with live data sources.

Sales analytics platforms like GoodData, Salesforce, or HubSpot automate forecasting using CRM data, logic rules, and real-time updates.

Consider your data quality, sales process, and team needs; most companies benefit from combining quantitative and qualitative models.