GoodData Brings Speed and Agility to Insurers with AI Powered Insights

Today we are excited to announce the availability of the GoodData insurance solutions on our industry-leading cloud analytics platform. Our insurance solutions are purposely designed to enhance insurance processes such as underwriting, claims management, and customer acquisition. Front-line employees can now obtain the insights they need to make informed decisions right at their point of work with insights embedded throughout their existing workflow.

Fig 1. Comprehensive view of underwriting KPIs via GoodData Underwriting Insights

With GoodData’s insurance solutions, insurers can dramatically improve operational efficiency while achieving faster insights delivery for the business users. The integrated machine-learning and AI capabilities allow continued improvement of decision-making by incorporating end user’s activities and responses into a closed-loop feedback system, resulting in greater business agility and better results for insurers.

When asked how analytics and insights were deployed and shared with the end users at a recent Chief Data and Analytics Officer for Insurance conference in Chicago, most CAOs and CDOs told us that it is either done manually, or handled by IT, both approaches can take anywhere from 6 months to multiple years to complete depending on the various data conditions, complexity of the process and people skills. Such delayed time-to-solution can make or break an insurance organization eventually in this digital era.

Given the urgency, GoodData’s insurance solutions are offered as accelerators built on top of GoodData’s Enterprise Insights platform. Our accelerators include out-of-the-box templates and data models, as well as professional services from GoodData, to help insurers jump-start their analytics project and drive tangible ROIs in a matter of weeks.

To learn more about GoodData’s insurance solutions, watch our webinar : “ Achieve Claims Excellence with Data and Predictive Analytics”.

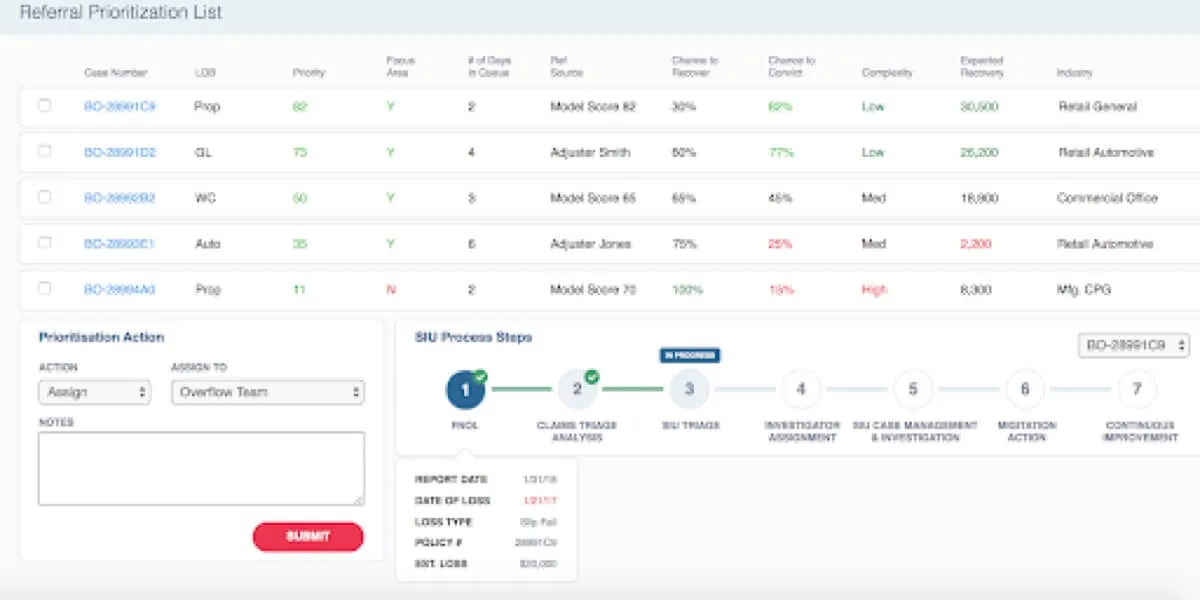

Fig 2. End-to-end visibilities for claims processing via GoodData Claims Insights

Data will continue to grow for insurers. The next insurance frontiers will be among those who can effectively leverage data to drive better business outcome and stay competitive. At GoodData, we are committed to helping insurers innovate by providing them advanced analytics tool sets needed to accelerate their digital transformation journey. Let us know how we can help you excel with data.

Experience GoodData in Action

Discover how our platform brings data, analytics, and AI together — through interactive product walkthroughs.

Explore product tours